A Note on NAV Financing

A recent trend that we’ve spotted in the private debt market is the proliferation of net asset value (NAV) loans used by private equity funds. NAV loans are debt facilities secured by a portfolio of assetsand the cash flows generated by those investments. Private equity managers use proceeds for various

purposes including distributing funds to LPs, injecting liquidity into existing portfolio companies, making add-on investments, addressing short-term working capital needs, etc. NAV loans are highly customizable, but typically have a 1-5 year maturity, sized based on 10%-50% of NAV and yields in the mid-teens.They are issued at the intermediate Holdco level, so they are subordinate to the PE fund’s operating company debt associated with project financing, leveraged buyouts, etc.

The recent proliferation of NAV lending can be attributed to the ongoing difficulties in the banking sector. Apart from rising interest rates and challenged balance sheets, stricter banking regulations enacted in late 2022 prompted large banks to pull back from the $800B fund financing business. These capital constraints led alternative asset managers, namely private credit funds, to step in and provide flexible financing solutions to the private equity ecosystem. Lenders are inclined to partner with PE funds that have mature portfolios, predictable cash-flowing assets, and strong potential for exit opportunities.

Private equity organizations with attractive track records and large, established platforms are viewed also more favorably. From a lender’s perspective, a challenge in evaluating these opportunities is the complexity and inconsistent data surrounding private valuations. NAV loan terms are set based on the residual equity of assets across a portfolio, so developing an accurate assessment of value and downside protection offered by the investments is key to the process. Covenants such as minimum NAV, interest coverage, and a minimum diversity ratio help safeguard lenders.

We believe NAV facilities are beneficial if used judiciously. They inherently add leverage to an already leveraged equation which deserves caution. Private equity LPs should recognize that while these facilities expedite the return of capital – boosting IRRs, TVPI and MOIC will suffer due to associated interest and transaction costs. Capital call facilities offer a similar trade-off; however, NAV loans are notably more expensive (given the less attractive collateral) which sets a higher bar for PE managers to deploy proceeds in an accretive manner. From a private credit investment perspective, we’ve reviewed

several NAV loan strategies and remain open-minded, but have not allocated to the space. More to come.

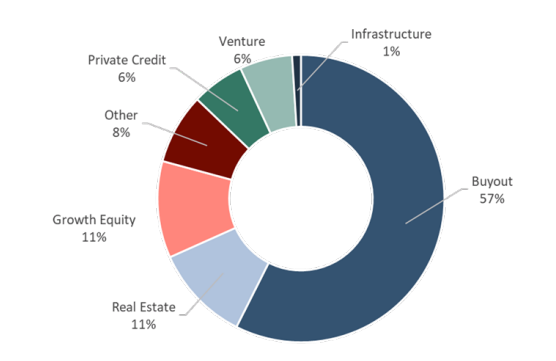

Fig. 1: Top NAV Borrower Strategy Profiles

The private debt market is witnessing a surge in the use of net asset value (NAV) loans by private equity funds. These loans, backed by asset portfolios, offer flexibility for various purposes. This trend is driven by challenges in the banking sector, prompting private credit funds to step in and provide alternative financing solutions.

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.