High Yield Bonds: Navigating Risk and Reward in a Changing Market

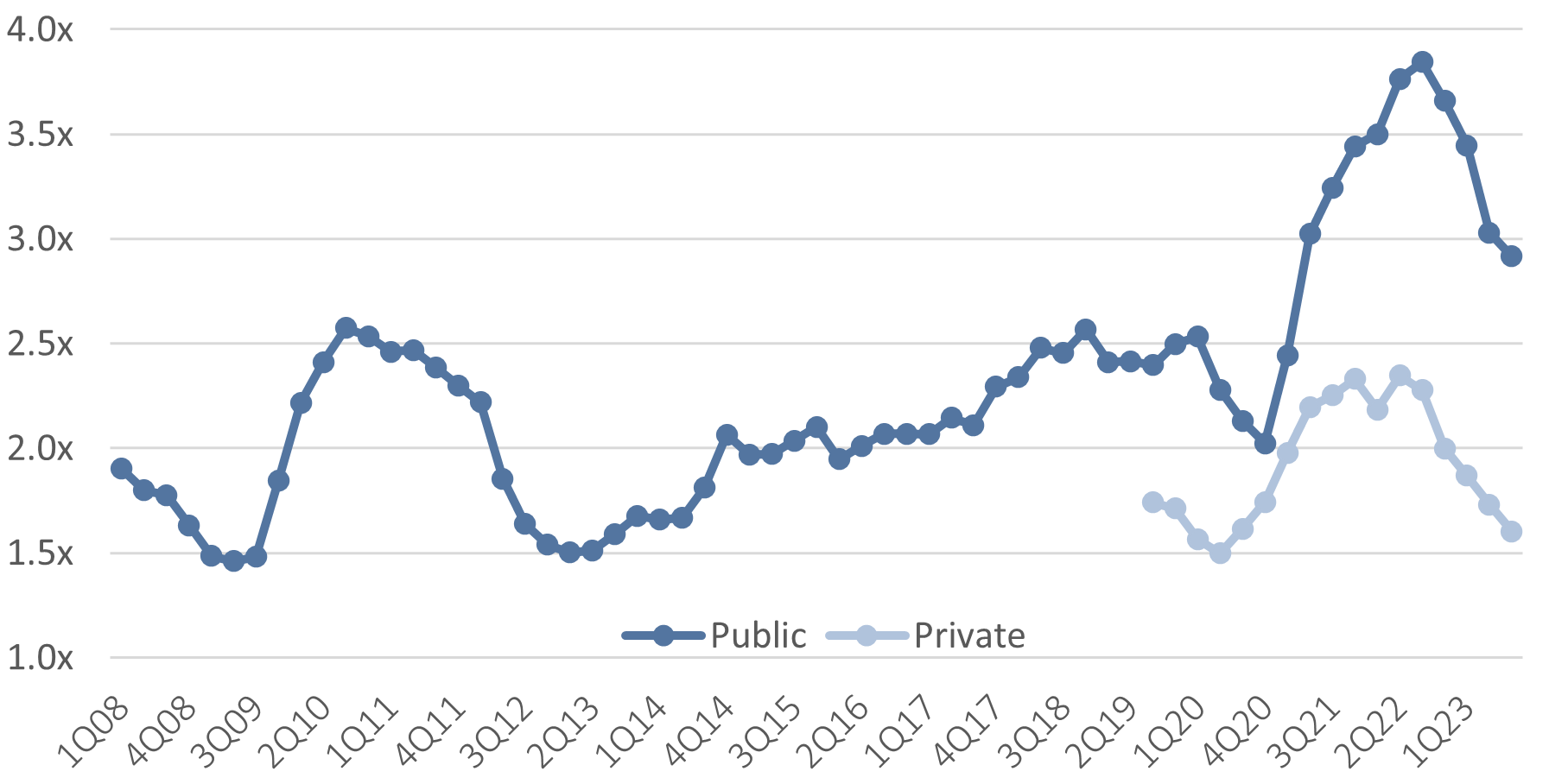

Fig. 1: Interest Coverage Ratio

High yield bonds generated strong returns in 2023, helped by the fourth quarter’s interest rate rally and narrowing credit spreads (i.e., compensation for risk over risk-free Treasuries). The sector ended the year up +13%, with yields trading at +323 basis points above Treasuries. Credit spreads rarely stay this low for an extended period.

When +300 basis points is breached, spreads are higher 88% of the time over the subsequent 12 months. Partially, for this reason, we are not ready to add exposure. But is it different this time?

The growing popularity of private lending has dramatically improved the risk profile of the public high yield universe. This shift is due to cuspier borrowers needing tailored funding options, turning to alternative lenders for capital market solutions. The result: the high-yield bond index is left with a basket of higher-quality companies. For example, fifteen years ago, CCC-rated borrowers (the riskiest slice of the non-investment grade universe) comprised 20% of the high-yield index. Today, it’s down to 12%. Financial metrics also point to improved quality. The average interest coverage (EBITDA-Capex/Interest Expense) and leverage (Debt/EBITDA) ratios for public high-yield issuers were 1.7x and 4.2x in 2Q14 when credit

spreads traded similarly to today. Since then, ratios have improved to 2.9x (interest) and 4.0x (leverage) for the cohort. This compares favorably to today’s private debt metrics of 1.6x interest coverage and 5.7x leverage [1].

Looking ahead, higher-quality public debt characteristics should result in lower defaults, improved recovery rates, and more resilient cash flow metrics. As such, while we believe the high yield sector’s relative valuation is not compelling today, structural changes to the market support the rationale for a lower average risk premium moving forward.

[1] JP Morgan

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.