Decoding the Recent Jump in US Treasury Rates

Last Week...

- Recent economic data does not line up with the Fed’s desire to reduce policy rates in the near term. Following a higher-than-expected CPI report last week, retail sales increased 0.7% from February to March (above expectations) and 4% year-over-year. Labor market reports continue to suggest a healthy job market.

- Treasury yields increased, pushing mortgage rates up. The average rate on a 30-year fixed mortgage is now 7.4%, up from 6.9% at the end of January.

- Multi-family housing starts have fallen 44% year-over-year, whereas single-family housing starts have increased 21% year-over-year.

- Middle East tensions continue to weigh on markets and push oil prices higher.

- Equities and bonds declined over the course of last week.

The 10-year US Treasury yield has increased by 0.4% (from 4.2% to 4.6%) since the beginning of April. The main drivers behind this sharp increase have been hotter-than-expected inflation and better-than-expected economic growth data. A jump of this magnitude—the bulk of the increase occurred within one week—is rare in the world of fixed income. For example, the 10-year note has experienced a similar or greater move only 18 times in the past decade, with two-thirds of those instances occurring since 2022.

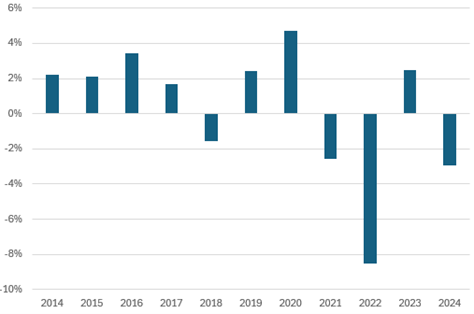

This latest selloff sends a clear message that inflation continues to keep market participants on edge. Even relatively small deviations from expectations- in this case, a forecasted monthly CPI increase of 0.3% vs. an actual of 0.4%- are enough to create ripples across equity and bond markets. The hard truth is that even though inflation is well below the 9% peak level of 2021, recent trends suggest progress toward the Fed’s 2% target has stalled. The possibility of rate cuts has been pushed further down the road. This resetting of expectations is driving another challenging period for fixed income investors. As of April 17th, the taxable bond market is down -2.9%, marking the fourth worst start to a year on record.

We have repeatedly noted over the past few months that upward pressure on rates should not come as a surprise. Our baseline forecast for 10-year yields remains within a range of 4.0% to 5.7%. This estimate is derived from a straightforward calculation that considers the Fed’s current forecast for the neutral rate at 2.5% and the market’s expectation of 4.6%.1 Assuming a 100 to 150 basis point premium over short rates (based on long-term averages), we estimate 10-year Treasury yields could range between 4.0% and 5.75% – our bias has been and remains toward the top half of that range.

Another way to evaluate 10-year rates is by looking at long-term inflation expectations (currently 2.34%2) and tacking on a term premium plus required real yield to account for the cost and uncertainty of holding a longer-term security. This gets you to approximately 4.5%. There are clearly several assumptions baked into that calculation, but the fact that long-term inflation expectations remain anchored at reasonable levels is important to the Fed’s analysis.

The good news? Taxable bond yields are back above 5.2%, an attractive level that boosts forward return expectations. Higher income means bond portfolios are much more resilient to market gyrations compared to the era of zero interest rates experienced from 2009 to 2021. We expect a continuation of near-term headwinds, but zooming out, the future looks promising.

1Yield on the 5-year Treasury note, five years from today.

2 https://www.clevelandfed.org/indicators-and-data/inflation-expectations

Fig. 1: Taxable Bond Market Returns through April 17th

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.