Will the Fed Cut Rates on Nov. 7?

Last Week

- The European Central Bank (ECB) has lowered its key interest rate from 4% to 3.75% for the first time since 2019, diverging from the Federal Reserve’s policy stance.

- The US economy shows signs of slowing, with personal income and spending growth falling in April and first-quarter GDP growth revised down to 1.3%, which may soon pressure the Fed to consider lowering interest rates.

- Chinese businesses are increasingly targeting Vietnam and Mexico as trade tensions with the US rise.

- Europe lags behind the US and China in investment, income, and productivity due to excess regulations, fragmented financial markets, and low investments.

Will the Fed Cut Rates on Nov. 7?

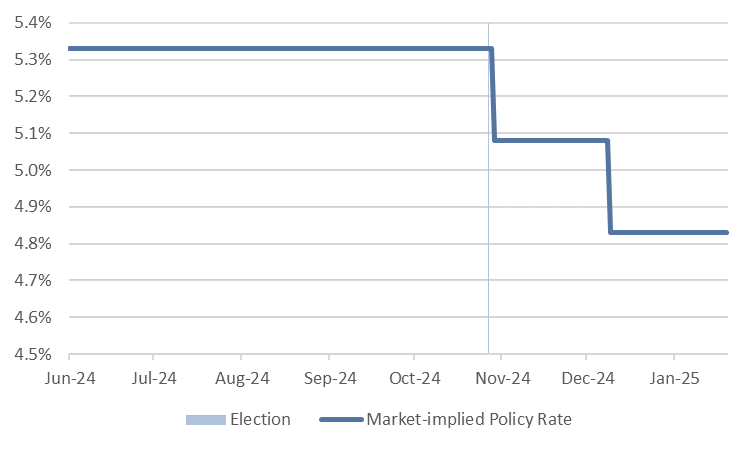

Market participants have priced in a tidy narrative for the Fed’s policy-making committee, the Federal Open Market Committee (FOMC), over the remainder of the year. The Fed Funds rate (essentially the yield paid on cash) will remain unchanged at the June, July, and September meetings and then the Fed will begin their rate-cutting cycle after election day with one cut at the Nov. 6-7 meeting and another cut either at the December 2024 or January 2025 meeting, and then another two cuts by mid-2025 (Fig. 1).

Fig. 1: Market participants expect the Fed to cut after the November election

Life is rarely so easy. While this particular path might work out for the Fed, it is more likely that either (1) a sharp deterioration of economic activity will force the Fed into rate cuts before November, or (2) inflation will remain elevated into the winter and the Fed will (once again) dash the hopes of market participants looking for lower policy rates. We don’t have any reason, at the current moment, to expect a significant slowing of economic activity, but recessions are rarely forecasted ahead of time.

There are, however, many identifiable factors that we believe will contribute to stubbornly high (above 2%) inflation and preclude a November cut. These include:

1. Wage pressure

Services make up 76% of consumption in the US. Wages are the primary driver of service inflation, and wage growth remains in the 4-5% range based on measures like the BLS Employment Cost Index and the Atlanta Fed’s Wage Growth Tracker.

2. Fiscal policy

Washington, DC, has normalized levels of deficit spending (6.3% of GDP in 2023) that used to be reserved for crises. Neither of the major political parties has put forth a credible plan to reduce deficit spending, and Treasury debt service is now nearly 7% of annual government outlays. Many economists believe that using new debt to pay interest on old debt is inflationary [1].

3. Immigration

We currently have at least 250,000 migrants entering the US on a monthly basis. This is a level of population growth that roughly matches the number of births we experience annually and is approximately equivalent to adding a new Los Angeles or two Philadelphias each year. While we could see substantial policy changes around undocumented immigration following the election, the current impact is positive for GDP growth but also inflationary.

4. Fed inertia

The Fed believes 2.6% represents the neutral (non-restrictive and non-accommodative) long-term policy rate. We believe the neutral rate is currently closer to 4-5%. It’s possible that many FOMC members agree with our view, but the Fed is a slow-moving, consensus-driven, bureaucratic organization that continues to tell market participants that lower rates are just around the corner. If the Fed continues to ignore their lying eyes, they could unintentionally stoke inflationary pressures.

Ultimately, the most important factor might simply be that the Fed makes a choice to preserve economic growth over inflation. The Fed has a 2% inflation target, but a healthy economy with stable inflation at 3% is likely more palatable to the Fed than inflation at 2% and an economy that’s in recession. While lip service will be paid to the inflation target, there’s no reason for an FOMC member to intentionally seek a recession and the hardships that it would bring over stable but slightly elevated inflation.

[1] https://en.wikipedia.org/wiki/Fiscal_theory_of_the_price_level

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.