How We Invest

Our Investment Philosophy & Process

Investing at Mill Creek is a customized, disciplined, research-intensive process that includes traditional and alternative assets. Our objective is to design portfolios that deliver equity-like returns with balanced portfolio risk characteristics over the course of a full market cycle. The results of the process serve as a starting point for customization based on our clients’ distinct goals and objectives.

Our Core Beliefs

Guiding Principles for Strategic Asset Management

A Margin of Safety Above All Else

We prioritize brute-force risk management to ensure portfolio survival through extreme market events. By maintaining sufficient portfolio liquidity and aligning with clients' risk tolerance, we aim to mitigate the impact of market downturns.

The Forecasting Hall of Fame has Zero Members

We reject speculative forecasts and instead focus on evidence-based strategies. Our investment decisions are grounded in rigorous research and analysis, rather than unreliable predictions.

Equities Drive Long-Term Returns

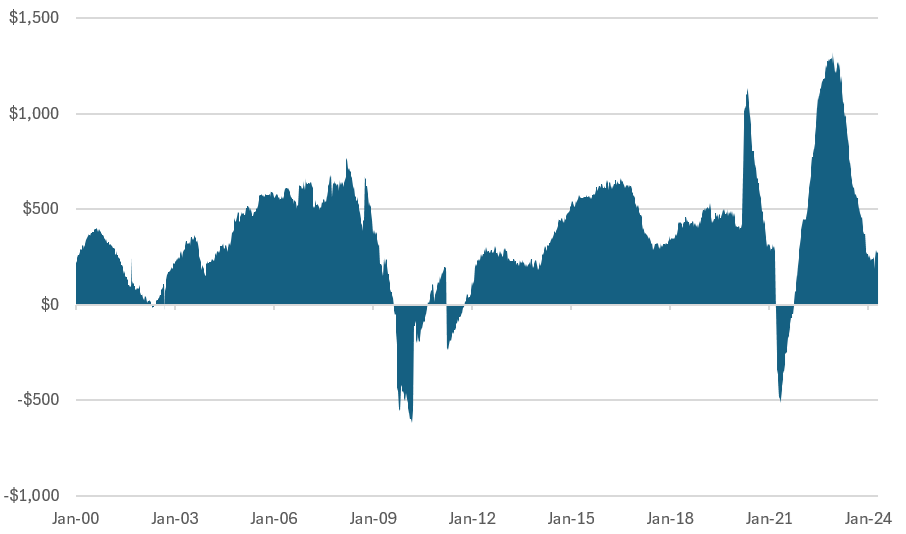

While equities offer the potential for long-term growth, we acknowledge the risk of volatility and sustained periods of underperformance. Our investment approach seeks to balance the growth potential of equities with strategies that create balance and manage risk over time.

Diversification is Better than a Free Lunch

We embrace diversification across all spectrums of the portfolio as a fundamental risk mitigation strategy. By spreading investments across different asset classes, geographies, managers, and even positions, we aim to reduce portfolio volatility and preserve wealth over the long term.

Net Returns Are the Only Returns That Matter

We prioritize after-fee and tax-efficient returns to meet specific investor goals and objectives. Our focus is on delivering net returns that align with our clients' financial objectives, rather than chasing headline performance metrics.

Our Investment Process

Driving Success Through a Deliberate Approach

Strategic Asset Allocation

We believe asset allocation and implementation are equal contributors to achieve allocation goals.

Tactical Positioning

We play offense when opportunities present themselves.

Implementation

We invest in diversified portfolios of niche asset managers that meet the due diligence standards we believe will lead to benchmark outperformance.

Customization

No one deserves a cookie-cutter portfolio. We construct portfolios around the specific goals and objectives of our clients.

Technology & Reporting

Operational Excellence is Not Just a Goal—It’s a Strategic Advantage

Harnessing advanced technology and comprehensive investment capabilities, Mill Creek executes on the asset allocation strategy defined for each client. Our platform provides comprehensive reporting functionality, offering deep analytics, consolidated reports, and real-time account monitoring. With Mill Creek’s technology, you gain transparency and accessibility, ensuring you’re always informed and connected.