Last Week...

- The US economy grew at an annual rate of 2.8% in the second quarter, surpassing economists' expectations. This growth was driven by increased consumer spending, business investment, and cooling inflation.

- President Biden announced he is ending his re-election campaign to "pass the torch" to Vice President Kamala Harris.

- US stocks had their worst day in 18 months, with the S&P 500 down 2.3% and the Nasdaq 3.6%, driven by sharp declines in tech stocks like Tesla, Nvidia, Microsoft, and Apple. Tesla dropped 12.3% after missing profit expectations, while Alphabet fell 5%.

- French and German business confidence has fallen sharply, increasing the likelihood of an ECB rate cut in September as both economies face a potential downturn.

- China’s central bank cut interest rates and injected over $25 billion to boost the economy, but economists say more direct fiscal spending is needed amid ongoing property and consumer confidence issues.

Buyer B-ware

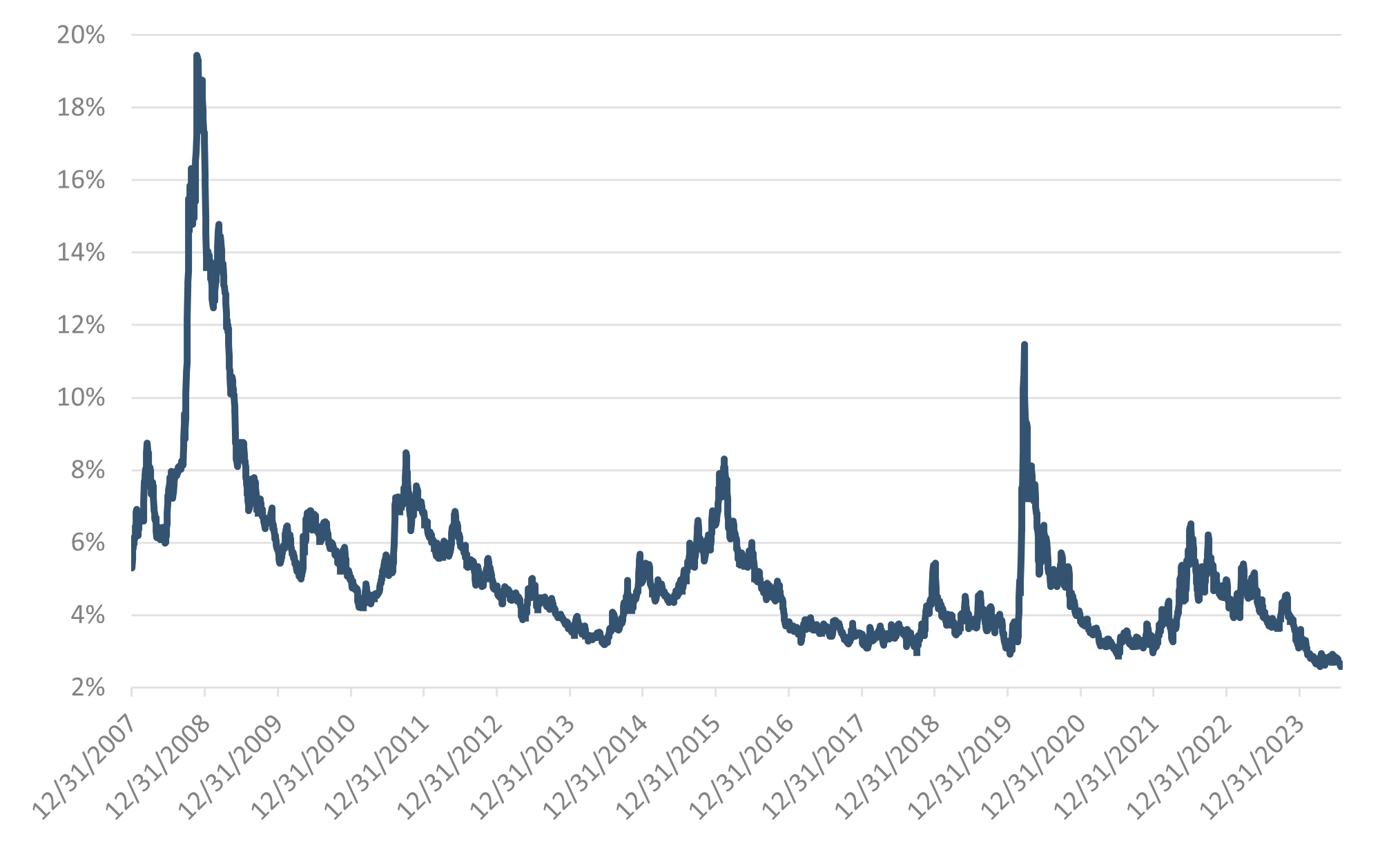

Credit spreads reflect the additional yield earned from a security compared to like-duration Treasuries. In other words, it’s the level of compensation investors need to assume a certain level of default risk over the risk-free alternative. Historically, investment-grade bonds have paid investors 150 basis points over Treasuries, while high-yield bonds have traded at more than three times that amount at 520 basis points. When credit spreads widen out, it’s a sign that perceived risk in the market has increased, causing investors to demand a higher return on capital. On the other hand, tighter spreads indicate confidence in fundamentals and capital market activity. Today’s spreads of roughly 90 basis points for investment-grade bonds and 300 basis points for high-yield bonds point to the latter scenario.

Today, what’s particularly interesting is the level of credit spread associated with the riskiest group of the liquid bond market. Last week, the Bloomberg B US High Yield Index’s credit spread hit a 16-year low at just 258 basis points over Treasuries (yield to worst of 7.3%). Credit spreads are currently narrow across the board, but extreme tightness for this specific group of companies points to another dynamic: the direct and growing competition from private credit managers (i.e., sponsored back corporate lending). As capital continues to flow into the space, borrowers are shopping between banks (syndicated public loan market) and private lenders to drive the most attractive pricing, covenants, and deal terms. Notably, borrowers that straddle both markets largely fall into the single B rating category, which helps explain the erosion of yield related to this segment of the market. It’s an enviable position for borrowers but leaves little room for error. We’ve often emphasized the importance of ‘picking your spots’ in the large and highly diversified private credit universe. This pricing dynamic is just another example of why we’re not ready to add this ‘flavor’ of debt to our private or public portfolios but continue to monitor the space for opportunities.

Figure 1: Single-B Rated US Corporate Credit Spreads

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.