September 2024 Update: Great Expectations

Last Week...

- The U.S. economy grew at a revised 3% annualized rate in Q2, up from 2.8%, driven by stronger consumer spending, which increased by 2.9%.

- German inflation unexpectedly fell to 1.9% in August, below the ECB's 2% target and down from 2.3% in July, increasing the likelihood of an ECB rate cut in September.

- The U.S. economy slowed slightly in August, with the PMI dropping to 54.1, while global economies like Europe and Japan showed resilience.

- Locked-in low-rate mortgages have provided U.S. consumers with an estimated $600 billion in extra spending power.

- Gold prices fell by 0.8% to $2,505.03 per ounce as a stronger U.S. dollar weighed on the market.

Great Expectations

“I expected 18 months of rate cuts against reason, against promise, against peace, against hope, against happiness, against all discouragement that could be.”

–2024 market participants (probably).

While we’re just having a little bit of fun with the above (slightly modified) passage from Charles Dicken’s “Great Expectations,” the global financial community waited with bated breath for Fed Chair Jerome Powell’s August 23rd speech at Jackson Hole to confirm their hopes that a rate cutting cycle was just around the corner. For Powell’s part, he fulfilled their hopes and dreams:

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

In plain English (my words, not his): the Fed is going to start a rate cutting cycle in September, but we don’t know how quickly we will cut nor do we know when we will stop.

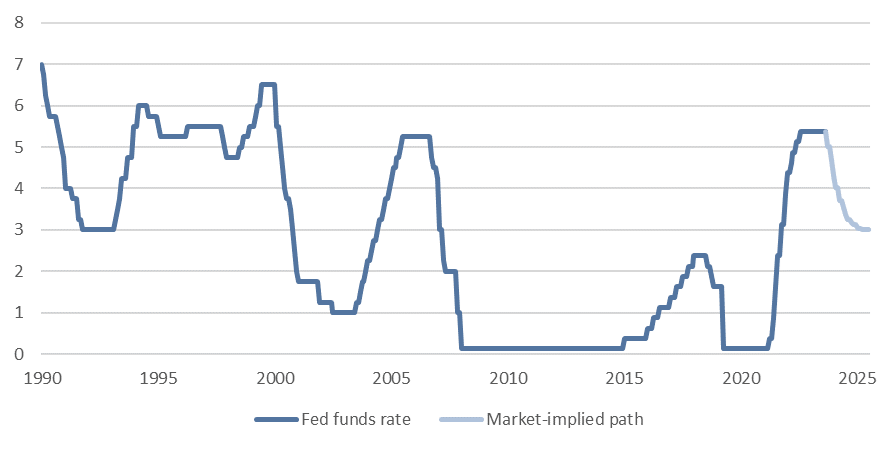

Mr. Market, of course, has a guess. The Fed funds rate is currently 5.375%. Market participants expect it to fall to 4.375% by the end of this year, 3.375% by mid-2025, and plateau around 3% as we head into 2026 (Fig. 1). These are, in our opinion, Great Expectations.

Fig. 1: Fed funds target rate

Buy the rumor, sell the news?

Markets have benefited over the last few months from the pricing in of rate cuts, but there are also risks that emanate from a rate-cutting cycle that we should consider.

For example, Powell’s clear guidance that the “timing and pace” of cuts will be data dependent has been unheralded by markets and a fairly-aggressive and uninterrupted rate cutting cycle has been priced in. At the same time, US economic growth remains at or above trend and inflation couple remain stubbornly above 2%. Unfulfilled rate cut expectations are now a risk worth watching for investors. A Fed pause would likely lead to another leg up in bond yields, and as we’ve seen numerous times in the recent past, higher yields would likely lead to a temporary risk-off period in equity markets.

We’ve experienced a nearly uninterrupted risk-on environment since last fall and frankly we expect rate cuts from developed country central banks to (at least initially) provide additional fuel to the cycle. As we discussed in our last Livestream, the three-legged US economic stool of households, firms, and banks remains very stable. We wouldn’t “sell the news” of rate cuts, but the temporary market stress from the unwinding of the yen carry trade in early August was a wake-up call for complacent investors. We’ve been in an abnormal, very low volatility environment; going forward the overhang of geopolitical risk, domestic economic and fiscal policy risk, and monetary policy uncertainty could result in a much more normal market than we have grown used to.

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.