The Fed Cut Cash Rates, but Where Will Long-Term Rates Go?

Last Week…

- The Fed implemented a bold half-point interest rate cut to avoid pushing the U.S. economy into a recession as inflation declines.

- Tech stocks surged, with the Nasdaq Composite gaining over 2%, as investors reacted positively to the Federal Reserve’s interest-rate cut.

- The Bank of England held its key interest rate at 5%, taking a more cautious stance than the Fed.

- U.S. home sales dropped by 2.5% in August, marking the fifth decline in six months, as mortgage rates did not sufficiently counteract high home prices.

The Fed Cut Cash Rates, but Where Will Long-Term Rates Go?

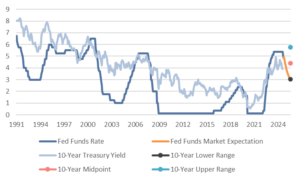

The Federal Open Market Committee (FOMC) of the Federal Reserve cut the Fed funds rate by 0.5% last week. At the current time, market participants expect the Fed to continue cutting the Fed funds rate to 3% over the next 12 months. For context, the Fed currently believes 2.9% is the “neutral” Fed funds rate (i.e. the rate that is neither restrictive nor accommodative to the economy).

If the Fed funds rate is falling, so should long-term interest rates, right? Since 1991, the 10-year Treasury bond yield has averaged 1.4% above the Fed funds rate with 1-standard deviation trading range of 1.3%. That means that if the Fed settles at 3%, a historically-reasonable range for the 10-year is 3.1%-5.7%, with a central tendency of 4.4%. While we don’t currently see 5.7% as realistic, longer-term interest rates could certainly stay at current levels, or move higher, as the Fed cuts.

Fig.1: The 10-year yield might move higher as the Fed cuts

Source: Bloomberg, Mill Creek.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.