Market Recap

- Israel launched military strikes throughout Iran late last week, targeting the nation’s nuclear program and killing multiple senior Iranian military figures. The attacks come as US talks with Iran over the latter’s nuclear program have stalled over recent weeks. Equity markets declined and oil prices spiked as much as +8% as investors assessed the potential for escalation.

- Officials from the US and China met in London this week to continue trade negotiations. According to the White House, the “framework” for a deal was reached which restored a truce between the two nations. While details are sparse, this framework supposedly includes US tariff rates on Chinese goods of 55%, Chinese rates on US goods of 10%, and US access to Chinese rare minerals.

- The NFIB Small Business Optimism Index increased in May, landing slightly above the survey’s long-term average, as business owners expect better conditions and higher sales volumes over the coming months. At the same time, the survey showed that uncertainty remains elevated, largely due to the rapidly evolving picture of global trade and the potential for changes in tax policy.

Subdued

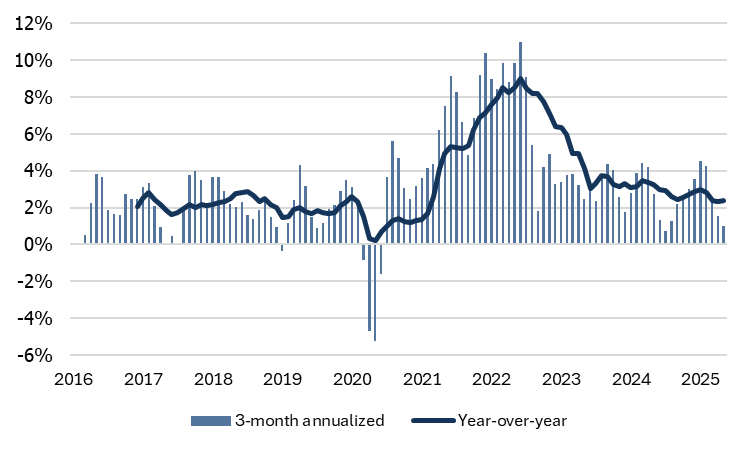

Last week’s Consumer Price Index (CPI) release further reinforced our view that inflation (Fig. 1) is, as we said in our quarterly outlook, “close enough for government work.” Year-over-year CPI increased by 2.4% and prices are only up 1% annualized over the last three months. Due to methodological differences, the Fed’s target of 2% for Personal Consumption Expenditures (PCE) due to translates to about 2.5% for CPI.

Fig. 1: Consumer Price Index

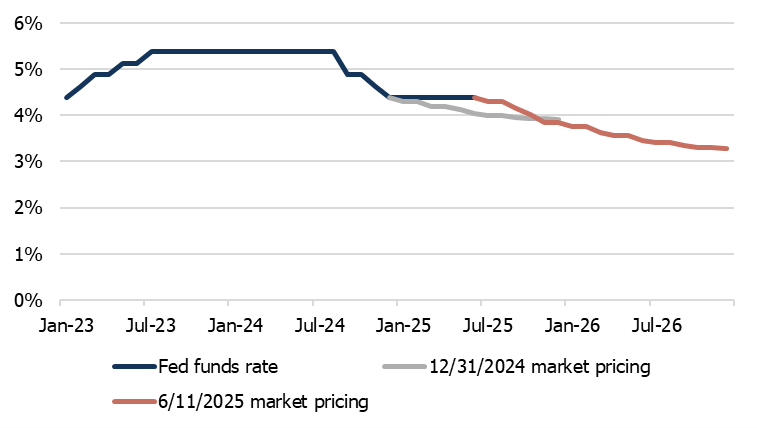

Inflation that remains at or around 2% should enable the Fed to lower rates gradually toward 3%. The market is currently pricing in four cuts to the Fed funds target between now and the end of 2026.

Fig. 2: Fed fund rate and market expectations

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.