Three Charts about the Dollar

Market Recap

- The Federal Reserve held rates steady at last week’s Federal Open Market Committee (FOMC) meeting, as was largely expected. Notably, FOMC members in aggregate decreased their projections for economic growth and increased their projections for inflation for this year, both by 0.3%, due to the uncertainty of the current trade conflict. The Fed’s “dot plot”, which summarizes each FOMC member’s expectations for future monetary policy action, remained consistent with the central bank forecasting two quarter-point interest rate cuts during the back half of 2025.

- US retail sales figures for May declined more than expected, dropping -0.9% relative to estimates of -0.6%. This figure followed a small decline in April (-0.1%) and conveys continued uneasiness from consumers around the direction of the economy.

Three Charts about the Dollar

- Despite the recent pullback, the dollar remains very strong against our trading partners and other developed currencies (Fig. 1).

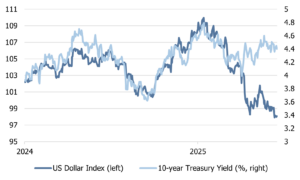

- The dollar and Treasury yields have recently diverged (Fig. 2).

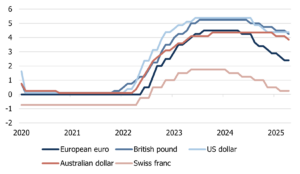

- The US dollar continues to offer among the highest yields of developed market currencies (Fig. 3).

Fig. 1: US dollar indexes

Source: Bloomberg, Mill Creek. Data as of 6/17/2025.

Fig. 2: US Dollar Index (DXY) and US 10-year Treasury Yield (%)

Source: Bloomberg, Mill Creek. As of 6/17/2025.

Fig. 3: Central bank policy rates

Source: Bloomberg, Mill Creek. As of 6/17/2025.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.