A Muni Market Misstep

A Muni Market Misstep

A developing story in the municipal bond market is reaching a critical juncture this week. It centers on Brightline, the high-speed rail line connecting Miami and Orlando. Launched in 2018, Brightline remains the only privately owned and operated intercity passenger railroad in the United States. More than $5 billion in debt was issued to fund its construction and related costs.

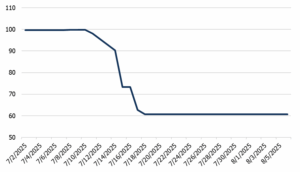

Fast forward to today: Brightline recently deferred an interest payment and now faces a $985 million mandatory bond repayment on Wednesday. The affected bonds, which were trading as high as $102 last month, have since fallen to $85. Other securities in the company’s capital stack are trading around $60. The primary driver of this deterioration is ridership coming in well below original projections.

Investors are watching closely, as Brightline is one of the largest and most liquid issuers in the high-yield municipal market. While Mill Creek does not currently have exposure to high-yield municipal bonds, this episode underscores the importance of manager selection and ongoing oversite in the riskier corners of the bond market. Several actively managed mutual funds hold significant allocations to these bonds, so the selloff is weighing on performance and flows. That said, if negative sentiment pushes prices to attractive levels, we could consider opportunistically allocating to take advantage of the dislocation.

Fig. 1: Brightline Tax-Exempt 12% Bonds, due 7/15/2032

Source: Bloomberg

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.