Charts of the Week: Artificial Intelligence is Leading a CapEx Boom

Charts of the week: Artificial Intelligence is Leading a CapEx Boom

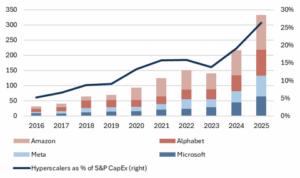

- Hyperscaler capital expenditures, used mainly to build AI infrastructure, have exploded upward over the last three years (Fig. 1) and now represent almost 30% of all S&P 500 cap ex.

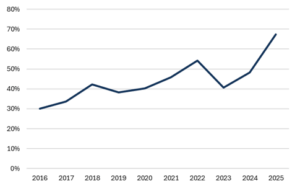

- Hyperscalers are financing this cap ex out of cash flows, not through borrowing. Approximately 70% of current revenues are being routed for AI investment (Fig. 2).

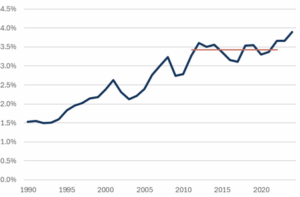

- CapEx is now 4% of US GDP (Fig. 3) and is responsible for 0.5-1% of GDP growth so far this year, exceeding the contribution from consumer spending.

What it means for investors:

After a period of anemic investment by large American corporations, AI optimism has led to a capital expenditure boom, particularly by the so-called hyperscalers (Amazon, Alphabet, Meta, and Microsoft), who are now dedicating nearly 70% of their revenues to AI-related investment.

Investors that are worried about an AI bust can take some solace in the fact that these firms have not been leveraging up to make the investment in AI, but debt and private credit are likely to play a larger role in financing investment if current forecasts are accurate.

Fig. 1: Hyperscaler cap ex investment (Billions)

Source: Bloomberg, Mill Creek.

Fig. 2: Hyperscaler cap ex as a percentage of operating cash flows

Source: Bloomberg, Mill Creek. 2025 excludes Alphabet.

Fig. 3: Cap ex as a percentage of GDP

Source: Bloomberg, Mill Creek. Orange line illustrates lack of growth in cap ex between 2010 and 2020.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.