Charts of the Week: The Labor Market is Slowing

Charts of the week: The Labor Market is Slowing

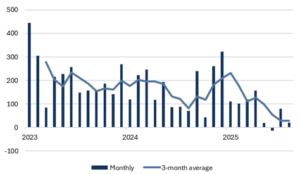

The Bureau of Labor Statistics (BLS) publishes a widely watched monthly labor market report known as the Establishment Survey. The Establishment Survey includes employment and earnings data collected from about 125,000 businesses across that are meant to be a representative sample of employment across the US. The Non-Farm Payroll report, which is part of the Establishment Survey, has shown a clear slowdown in hiring this year (Fig. 1).

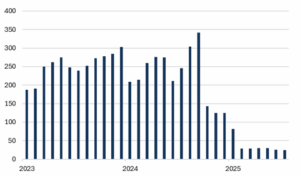

One reason for the slowdown in payroll growth has been the near sudden stop of net immigration, which has potentially fallen by 200,000 or more per month (Fig. 2).

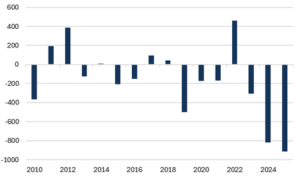

Once a year, the BLS reconciles the Establishment Survey with unemployment insurance tax records, which are considered more accurate but take longer to compile. Adjustments are usually small, but last week’s preliminary revision indicated that job growth between April 2024 and March 2025 was likely overstated by 911,000 jobs. This will be the second year in a row that the Establishment Survey overestimated job growth by an unusually high amount (Fig. 3).

In sum, the labor market wasn’t as strong in 2024 as US economic data indicated, and it slowed even further this year.

Fig. 1: Non Farm Payroll Growth (Thousands, January 2023 – August 2025)

Source: Bloomberg, Mill Creek.

Fig. 2: US Border Control encounters (Thousands, January 2023 – July 2025)

Source: Bloomberg, Mill Creek.

Fig. 3: Benchmark Payroll Revisions (Thousands, 2010-2025)

Source: Bloomberg, Mill Creek.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.