BDC Blues: A Warning Sign for Private Credit?

BDC Blues: A Warning Sign for Private Credit?

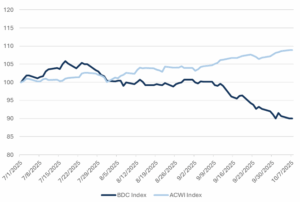

Publicly listed Business Development Companies (BDCs) have hit a rough patch since mid-July, underperforming the broader equity market by ~18 percentage points. BDCs are closed-end funds that provide private loans to small and mid-sized US companies. Investors are typically drawn to BDCs for their high dividend yields, funded by the interest income generated from these loans. We believe the repricing of forward earnings reflects the implications of a new rate cutting cycle and heightened credit concerns following the abrupt default of First Brands Group, an auto-parts supplier.

In terms of the interest rate environment, most BDC’s own loans that are floating rate, so as base rates decline, the income generated from these assets decreases. Second, BDCs are leveraged vehicles, typically carrying between 1.5x and 2.0x debt-to-equity. They often use longer term, fixed-rate debt to fund their purchases. If the yield curve steepens, as many anticipate, BDC borrowing costs will rise. The combination of lower asset yields and higher funding costs compresses net interest income (a proxy for BDC dividends). Because most investors own BDCs primarily for income, a higher risk of dividend cuts puts pressure on their stock price.

From a credit perspective, defaults have remained low but the well publicized collapse of First Brands has spooked the market and accelerated the selloff in BDCs over the past week. Details of the default are still emerging, but a handful of publicly and privately traded BDCs reportedly had direct exposure to the company’s debt. These vehicles tend to hold highly diversified loan portfolios due to regulatory requirements, so the resulting write-down should be manageable. While we don’t expect a meaningful spillover into the broader private credit markets, this episode reinforces the importance of diversification across an investment portfolio. BDCs are concentrated in one segment of private credit: they hold leveraged, floating-rate loans backed by the cash flows of small and mid-sized businesses. This profile performs well in most scenarios but is sensitive to shifts in the broader economy. On the other hand, our private debt platform holds a mix of floating and fixed rate debt across a range of collateral types such as real estate, farmland and hard assets. We also focus on low leveraged funds (0.0x-0.5x) to reduce risk and sensitivity to borrowing costs. While this approach sacrifices some yield in strong markets, we believe it offers a more defensive solution and greater stability through economic cycles, playing an important role in a well-diversified investment portfolio.

Fig. 1: Performance of BDCs vs ACWI

Source: Bloomberg, Mill Creek as of 10/7/2025.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.