Flying Blind? Not Exactly. Six Charts That Tell The Story.

Flying Blind? Not Exactly. Six Charts That Tell The Story.

We’re now one month into what appears likely to be the longest US government shutdown in history. One casualty of the shutdown: economic data. Aside from October’s Consumer Price Index, which was released as a special exemption to allow the Social Security Administration to calculate the 2026 cost-of-living-adjustment (COLA), federal agencies haven’t been able to publish their normal calendar of economic data.

Fortunately, there’s reasonable amount of private economic data that we can use as a proxy for the official data. Currently, private economic data indicates:

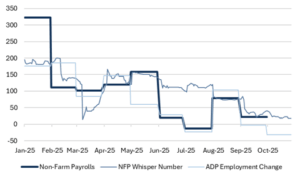

- Hiring continues to slow (Fig. 1),

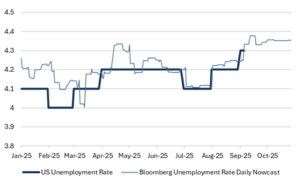

- The unemployment rate is likely 4.3-4.4% (Fig. 2),

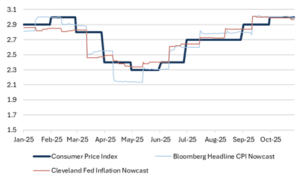

- Inflation is around 3% year-over-year (Fig. 3),

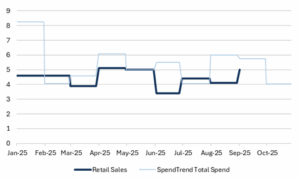

- Retail sales remain strong at 4-5% growth (Fig. 4),

- Overall GDP growth is trending at 4% for the 4th quarter (Fig. 5), and

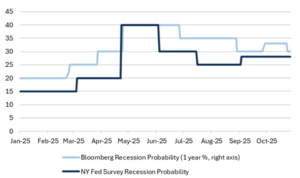

- Survey and market-based measures of recession probability haven’t changed during the shutdown (Fig. 6).

Why it matters

The current shutdown came at an already-confusing time for the US economy, but the private data tells us that not much changed over the course of October. Job growth has stalled, inflation remains elevated, and a combination of consumer resilience and AI investment is keeping GDP growth well-above trend. These factors, at least in the near term, remain supportive for equity and credit.

Fig. 1: Payroll growth continues to slow

Source: Bloomberg, Mill Creek. As of Oct 27, 2025.

Fig. 2: Unemployment remains near 4.3%

Source: Bloomberg, Mill Creek. As of Oct 27, 2025.

Fig. 3: Inflation remains near 3%

Source: Bloomberg, Mill Creek. As of Oct 27, 2025.

Fig. 4: Retail sales continue to grow at around 5%

Source: Bloomberg, Mill Creek. As of Oct 27, 2025.

Fig. 5: GDP growth appears strong at nearly 4%

Source: Bloomberg, Mill Creek. As of Oct 27, 2025.

Fig. 6: The probability of a recession hasn’t changed during the shutdown

Source: Bloomberg, Mill Creek. As of Oct 27, 2025.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.