Aftermath

We’re two full months after Liberation Day, and we now have a reasonable amount of economic and market data to start gauging the initial impact of tariff policy. The title of this commentary overstates where we are at in the Trump Administration’s effort to redefine our international trading relationships, which we expect to be an ongoing effort through the balance of President Trump’s term, but it feels appropriate to the extent that market volatility has subsided, and markets are once again nearing all-time-highs.

Here’s what we know so far:

- Consumer sentiment remains low but stabilized in May.

Fig. 1: University of Michigan Consumer Sentiment Index

Source: Bloomberg, Mill Creek. Data as of May 31, 2025

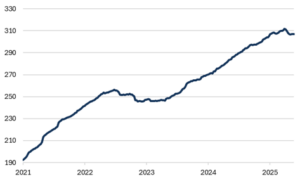

2. There is little evidence that consumers changed behavior discernably in April. Consumers accelerated some purchases into March, but retail sales have grown at an annualized rate of 7.3% over the last three months.

Fig. 2: Retail Sales less Autos and Gas

Source: Bloomberg, Mill Creek. Data as of May 31, 2025.

3. Jobless claims have not increased, and businesses appear to be taking a wait-and-see approach to layoffs.

Fig. 3: US Initial Jobless Claims (weekly)

Source: Bloomberg, Mill Creek. Data as of May 31, 2025.

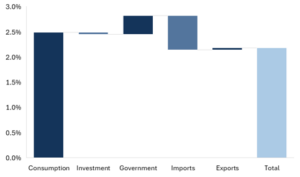

4. The Atlanta Fed GDPNow Index indicates we are on track for real GDP growth of 3.8% this quarter. However, in a sign that policy uncertainty is weighing on long-term decision-making, investment spending on equipment, new commercial real estate, housing, and inventory appears flat to negative.

Fig. 4: Atlanta GDPNow estimate for 2Q 2025

Source: Bloomberg, Mill Creek. Data as of May 31, 2025.

5. Corporate earnings guidance has come down for 2025 and 2026, but only modestly. Most US firms have said tariffs would have a limited impact on their earnings.

Fig. 5: S&P 500 estimated earnings per share, next 24 months

Source: Bloomberg, Mill Creek. Data as of May 31, 2025.

6. To the extent we see signs of stress, it is in the bond market. Bond holders are requiring additional compensation to buy longer-term government bonds instead of implicitly seeing them as a safe asset for volatile markets.

Fig. 6: 10-Year Treasury term premium

Source: Bloomberg, Mill Creek. Data as of May 31, 2025.

In summary, the US economy has proven to be resilient to policy uncertainty and tariff headwinds. Markets have responded accordingly and retraced back to their pre-tariff levels, but bond markets in developed countries are signaling apprehension about long-term fiscal sustainability.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.