April’s Economic Data is Holding Firm

April’s Economic Data is Holding Firm

One of the big questions coming out of April has been whether Liberation Day, which quickly pushed down consumer and investor sentiment, would show up in April’s economic data.

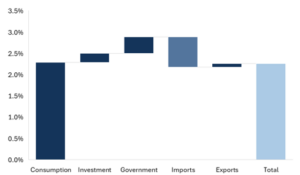

First, we cautioned that the first quarter GDP would likely come in negative due to a front-loading of pre-tariff imports. The initial first quarter GDP release was, in fact, negative, but the second quarter GDP, as measured by the Atlanta Fed GDPNow Index, is back on track at +2.3%. Consumption has notably held up in the face of lower consumer sentiment and equity market volatility.

Fig. 1: Atlanta Fed GDP Now Index, (Q2 estimate)

Source: Bloomberg, Mill Creek.

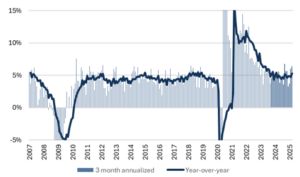

Second, we believe aggregate income growth (the total quantity of wages paid to all employees) is one of the most important economic health indicators for the US. When aggregate incomes are growing, households can pay their mortgages, car payments, and continue to consume at a normal growth rate. Aggregate incomes increased by an annualized 3% in April and exhibited accelerating growth over trailing 3 and 12 month periods (Fig. 2).

Fig. 2: US Index of Aggregate Weekly Payrolls (% growth)

Source: Mill Creek, Bloomberg.

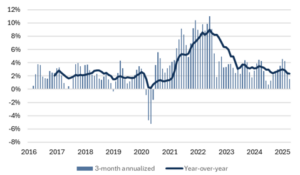

Third, the Fed also received some good news regarding inflation. The Consumer Price Index (CPI) fell to 2.3% year-over-year and has increased at a 1.6% annualized rate over the last three months. Core CPI, which excludes food and energy prices, has declined from 3.2% at the end of 2024 to 2.8% today.

Fig. 3: US Consumer Price Index

Source: Mill Creek, Bloomberg.

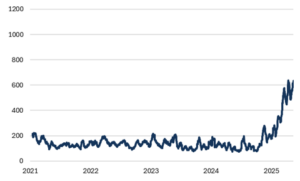

While April’s economic data presents mostly reassuring news so far, we caution against an “all-clear” mindset. Good news is good news, but economic policy remains highly uncertain (Fig. 4). In addition to fluctuating tariff policy, we are likely to see new policy challenges (e.g., raising the debt ceiling, passing a budget deal, and fiscal deficits) over the remainder of 2025.

Fig. 4: Economic Policy Uncertainty Index

Source: Bloomberg, Mill Creek.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.