Back to the Small Cap Future

Last Week...

- US inflation eased to 3% in June, the lowest since June 2023, indicating a significant slowdown in price increases.

- The subdued inflation supports expectations for a potential interest rate cut by the Federal Reserve in September, with markets speculating on multiple cuts through the end of the year.

- Despite higher interest rates, risky corporate loans offering approximately 9% yields are attracting investors due to low defaults and a favorable economic outlook. This leads to substantial inflows and increased refinancing activity among low-rated businesses.

- Real-estate stocks rallied as June's inflation data eased, making them the S&P 500's top performers on Thursday.

- The Bank of Korea maintained its benchmark interest rate at 3.50% for a record twelfth consecutive time despite growing expectations for future rate cuts amid easing inflation and economic pressures.

- Huw Pill of the Bank of England suggests future rate cuts are likely but warns of persistent inflationary pressures from rising services prices and wages, indicating caution in immediate rate adjustments.

Back to the Small Cap Future

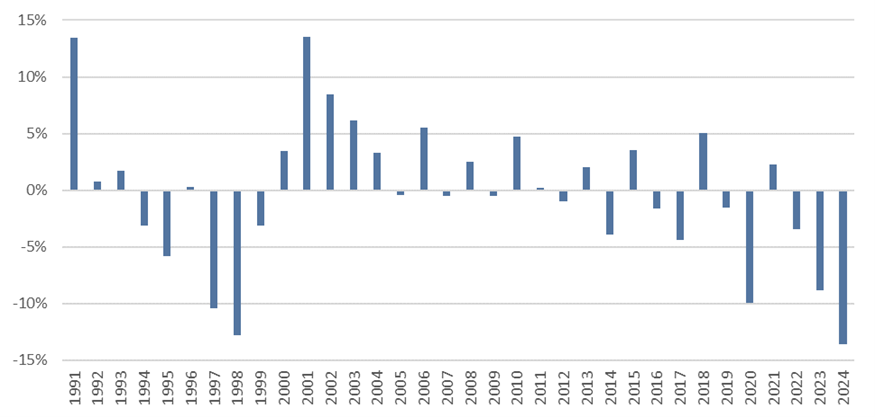

Small cap US equities (companies with market capitalizations of $200mn to $10bn) just experienced the worst first half of a calendar year, relative to large cap equities, in 34 years (Fig. 1). Perhaps even more striking, over the last three years the Russell 2000 Index, a commonly used index for small cap stocks, has underperformed the S&P 500 by approximately 11% per year. Small cap comprises about 7% of the total US equity market. Our equity portfolios have an approximate 5% target allocation.

One might ask why we maintain the small cap position considering the recent underperformance.

Fig. 1: January-June small cap vs. large cap performance, 1991-2024

Such extremely small underperformance hasn’t occurred since the late 1990s, which was a period that shared some similar characteristics with today:

We don’t want to take the dot-com parallel too far because there are also plenty of differences between the late 1990s and today. The most important thing is simply that the best-performing “Magnificent 7 (M7)” companies produce substantial earnings and free cash flow, which was not the case with the late 1990s stock market darlings. On the other hand, concentration risk is a more concerning factor. Apple, Microsoft, NVIDIA, and Amazon are all individually larger components of the global stock market than the entirety of China. Investors have enough exposure to the current stock market darlings, and small cap should provide some protection, as it did in the early 2000s, if the M7 were to fall out of favor. Additionally, a less-restrictive Fed should benefit call cap stocks. Last Thursday’s CPI number further bolstered the case for a September or November rate cut and small cap responded with the third best 1-day performance (+ 4.4%) against large cap in 35 years. The relative performance between small cap and the M7 on Thursday was even more astonishing: +7.8%.

|

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.