Boomer Candy is Bad for Your (Portfolio’s) Health

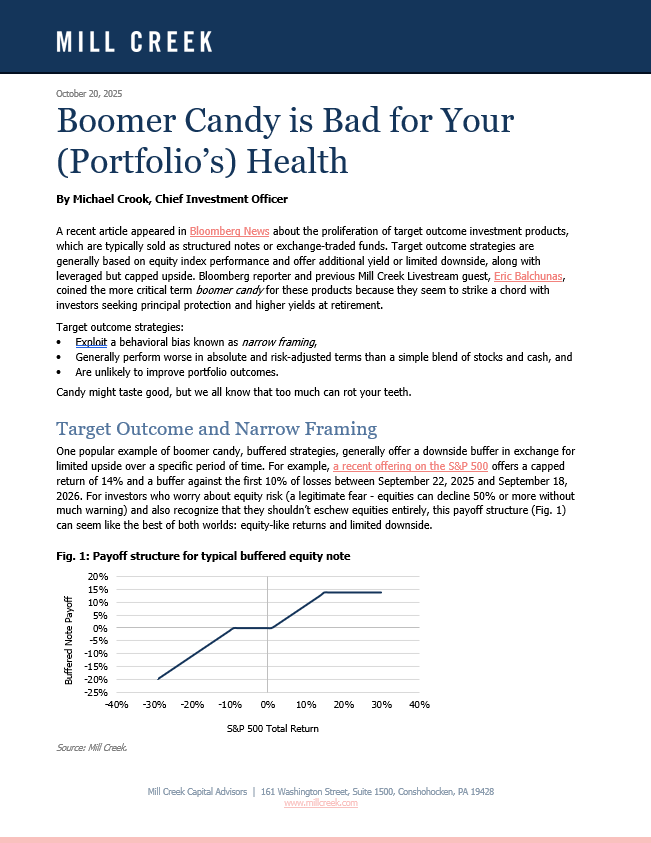

A recent article appeared in Bloomberg News about the proliferation of target outcome investment products, which are typically sold as structured notes or exchange-traded funds. Target outcome strategies are generally based on equity index performance and offer additional yield or limited downside, along with leveraged but capped upside. Bloomberg reporter and previous Mill Creek Livestream guest, Eric Balchunas, coined the more critical term boomer candy for these products because they seem to strike a chord with investors seeking principal protection and higher yields at retirement.

Target outcome strategies:

- Exploit a behavioral bias known as narrow framing,

- Generally perform worse in absolute and risk-adjusted terms than a simple blend of stocks and cash, and

- Are unlikely to improve portfolio outcomes.

Candy might taste good, but we all know that too much can rot your teeth.

Read our latest white paper from Chief Investment Officer Michael Crook here.

Read why Boomer candy is bad for your (portfolio's) health here.

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.