Calling The Top? Two Contrarian Charts About Last Week’s Sell-Off

Calling The Top? Two Contrarian Charts About Last Week’s Sell-Off

Equity markets took a breather last week against the backdrop of an above-average year. The sell-off was mainly concentrated in US growth and technology stocks, which includes AI-exposed firms like NVIDIA, Microsoft, and Alphabet. Media coverage, in our opinion (e.g. “Dow plunges 613 points as AI bubble fears explode”), was overblown:

- Last week’s declines were completely normal in a statistical sense. Growth and technology stocks, which are more volatile than the broader equity market, experience frequent 5-10% declines (Fig. 1).

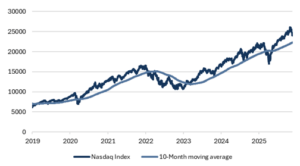

- Last week’s decline was not significant enough to signal the start of a long-term bear market. If certain technical indicators, like the 10-month moving average, are breached we would be much more cautious (Fig. 2).

Why does this matter for investors?

We are entering a complicated period for investors, who must balance late-cycle high equity valuations with early-cycle stimulative monetary and fiscal policy. Risks worth watching include higher bond yields, a hawkish Fed, and concrete messaging from the Magnificent 7 that AI revenue targets will not be achieved. Until then, we remain comfortable with a modest pro-growth tilt, with the continued awareness that we’re closer to the end of the cycle than the beginning.

Fig. 1: Peak-to-trough drawdowns for the Nasdaq Index

Source: Bloomberg, Mill Creek. As of November 21, 2025.

Fig. 2: The decline hasn’t been substantial enough to indicate a market top

Source: Bloomberg, Mill Creek. As of November 21, 2025.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.