Chart of the Week

Chart of the Week

Are Credit Defaults Picking Up?

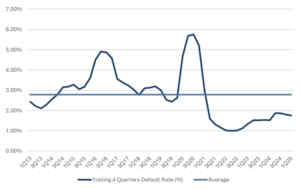

Private credit default rates have edged up slightly from their late-2022 lows but remain well below the longer-term average of 2.78%. This trend is consistent with what we’re seeing in the public markets. As of 1Q25, the trailing 12 month default rate in the liquid leveraged loan market stood at just 0.78%. A combination of supportive economic conditions and healthy capital markets has enabled most borrowers to meet their debt service obligations. Tight credit spreads reflect market confidence that this stability will persist and that management teams can successfully navigate new policies accordingly. We continue to view private credit as an attractive source of absolute yield relative to other asset classes, though we caution that certain segments appear ‘priced for perfection,’ and remain highly selective around the investments we pursue.

Fig. 1: Trailing 12 month Default Rate, BDC Universe as of 3/31/25

Source: Cliffwater, Mill Creek

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.