Current State of US Housing Market

Current State of US Housing Market

The US housing market is stuck:

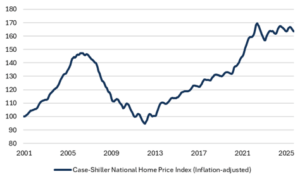

- National home prices have flatlined on an inflation-adjusted basis (Fig. 1),

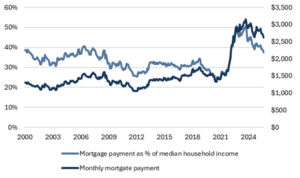

- But new mortgage payments remain somewhat high in absolute terms and as a percentage of household income (Fig. 2).

- “Months of supply” for new homes also remains very high, creating a disincentive for home builders (Fig. 3),

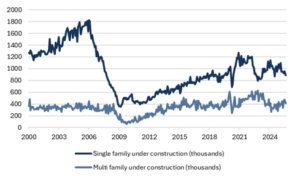

- Which has pushed single-family (and multi-family) starts down about 30% from 2022 levels (Fig. 4).

Why this matters for investors

Homeowners are wed to 2021/2022 prices but higher mortgage costs are a headwind to home prices. Transactions generally only occur when (1) a mortgage isn’t necessary for the transaction, (2) someone has to sell (divorce, death, etc), or (3) builders have inventory they need to move. Plenty of buyers are out there, but not at current sales prices. Transactions will occur gradually unless market fundamentals (e.g., much lower mortgage rates) open the market again. Ultimately, inflation will erode real home values, even as nominal values climb, and put the market back in equilibrium.

Though impacted by separate factors, it is possible to draw parallels between current US housing market and post-2022 private markets. In private equity, this phenomenon shows up as limited distributions against a backdrop of a wide-open IPO market. Many businesses are still marked at 2021/2022 values, but LPs have no forcing mechanism for transactions. Therefore, fund managers will only transact when company fundamentals have improved enough to justify earlier valuations. Like home prices, inflation might play a role in eventually squaring this circle by pushing up nominal values even as real values remain steady or decline.

We are speaking in generalities, of course. Some parts of the US housing market, like Cape Coral, Florida, have significant “forcing mechanisms” (e.g., rising insurance costs) that have resulted in enough transactions to see meaningful price declines. Some private equity portfolio companies have increased earnings enough to go public without requiring a hit to the fund’s performance. But these are exceptions to the rule. Many private asset marks remain above the market-clearing price and will remain stuck for the time being.

Fig. 1: Home prices have flat-lined on an inflation-adjusted basis

Source: Bloomberg, Mill Creek. As of 11/6/25.

Fig. 2: Mortgage payment for median-priced US home at prevailing mortgage rate

Source: Bloomberg, Mill Creek. As of 11/6/25.

Fig. 3: There are almost 9 months of new homes on the market today

Source: Bloomberg, Mill Creek. As of 11/6/25.

Fig. 4: Single and multi-family housing starts

Source: Bloomberg, Mill Creek. As of 11/6/25.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.