December Update: What Is the Fed’s 2024 Mandate?

The Federal Reserve Act mandates that the Fed conduct monetary policy to “promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” It doesn’t specify how the Fed should balance these often conflicting goals, nor does it discuss when the Fed should prioritize one goal versus another.

From a practical standpoint, the Fed has determined that an inflation rate of 2% satisfies the “stable prices” part of the mandate and tends to look at a range of employment-related indicators in judging the health of the labor market. Moderate long-term interest rates are typically considered a byproduct of success at the first two objectives.

As we’ve written in the past, the Fed struggled to balance inflation and employment during the 1970s but more-or-less successfully balanced their dual objectives in the 1980s and 1990s. The 2000s, 2010s, and 2020s haven’t required much balance. During the 2000s and 2010s, inflation remained low and the Fed was able to focus nearly exclusively on supporting economic growth. Any economic hiccup (potential or real) brought a quick and decisive accommodative response from the Fed. During this period, Economist Tim Duy, whose research serves as input into our investment process, coined the phrase, “The Federal Reserve wants to kill your recession call.”

The last few years have required the Fed to focus primarily on inflation. In fact, the Fed’s own outlook implied the tight monetary policy would result in a recession this year. They were wrong (so far) about a recession, but the emphasis on inflation was the important message. They needed credibility in the fight against inflation and wanted to be clear that, on balance, getting back to price stability was more important than maximum employment.

Back in Balance?

Near-term measures now indicate inflation is running at 2.5-3.5%. While the Fed would like to see inflation back at 2%, it is unlikely that they would accept a recession to get it there. Similarly, labor markets remain very healthy, but the unemployment rate has increased from 3.4% in early 2023 to 3.9% today.

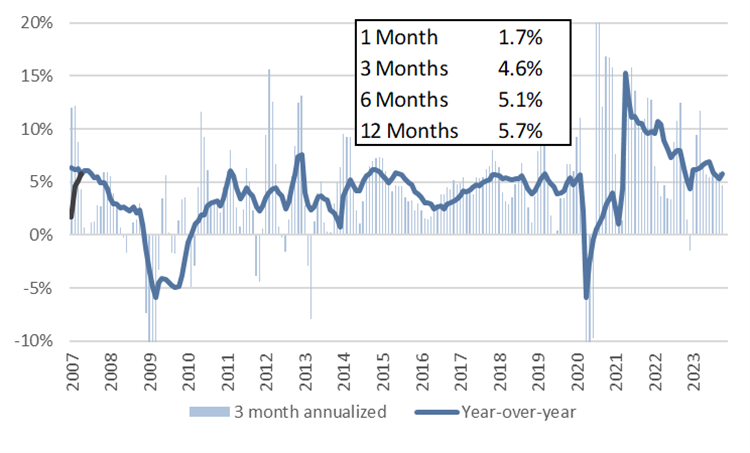

Aggregate Personal Wage and Salary Disbursements appear to be stabilizing around 5%. Aggregate wages should closely align with nominal GDP. Stabilizing at a 5% growth rate is a pretty good outcome and bolsters the view we laid out in “That’s All, Folks!” that the Fed finished hiking in July.

Fig 1: Aggregate Personal Wage and Salary Disbursements

The current 5% aggregate wage growth could equal 2% real growth + 3% inflation, or 3% real growth + 2% inflation, or some other combination. It doesn’t really matter because it means the overall size of the economy is growing at a reasonable rate and the Fed can shift their narrative from “we’re inflation warriors come hell or high water” to one that signals more balance between labor markets and inflation.

The bond market is currently pricing in a 50% chance of a cut by March 2024. At this point, we’d put a greater than 50% probability of a 25bps cut in March 2024, but are less confident about further cuts through the course of 2024. A narrative change and one rate cut allow the Fed to move past their heightened focus on inflation and lean into a balanced concern about growth and inflation.

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.