Last week...

- Core retail sales grew 0.1% in August, indicating that US consumers could absorb higher gas prices and keep spending elsewhere.

- Producer Price Index data came in hotter than forecasted for August.

- US labor markets continue to show resilience and strength. Unemployment claims data remains strong.

- While the Fed is almost certainly not going to raise rates at the FOMCE meeting this week, the European Central Bank raised its main policy rate to 4% last week,and the Bank of England is likely to raise its policy rate to 5.5% this week.

- China continues to be a source of concern for the global economy. New economic data indicates that the economy picked up in August (retail sales and industrial production beat estimates), but home prices continue to fall, and salaries have also declined year-over-year in Shanghai.

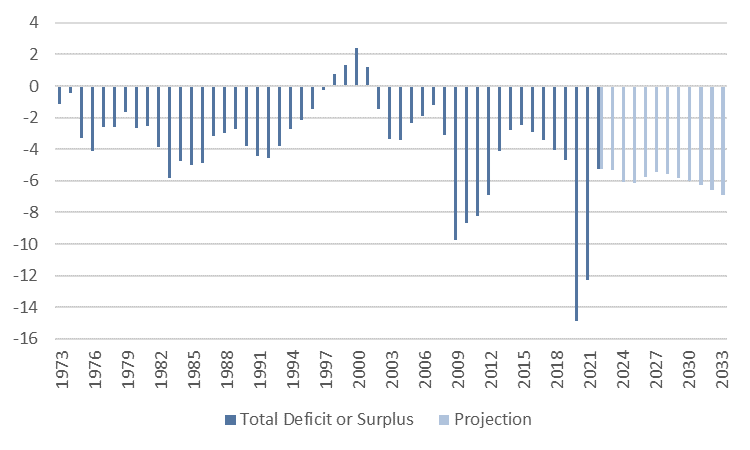

Recent Congressional Budget Office (CBO) forecasts point to a worsening fiscal picture for the United States. The deficit projections we highlighted in April (Red, White, and Overdue) have been revised to forecast a doubling of the deficit from $1 trillion in 2022 to $2 trillion in 2023 and sustained deficits as a percentage of GDP of 6-7%. These are levels of deficit spending that have only previously been seen during World War 2 (1942 and 1943) and severe economic crises (2009 and 2020).

Fig. 1: US federal deficit as a percentage of GDP

Net interest outlays (interest payments on outstanding government debt) are projected to increase to 3.6% of GDP by 2033 and are a significant driver of the worsening fiscal picture. For context, net interest outlays averaged 1.5% of GDP for the two decades spanning 2003 and 2022.

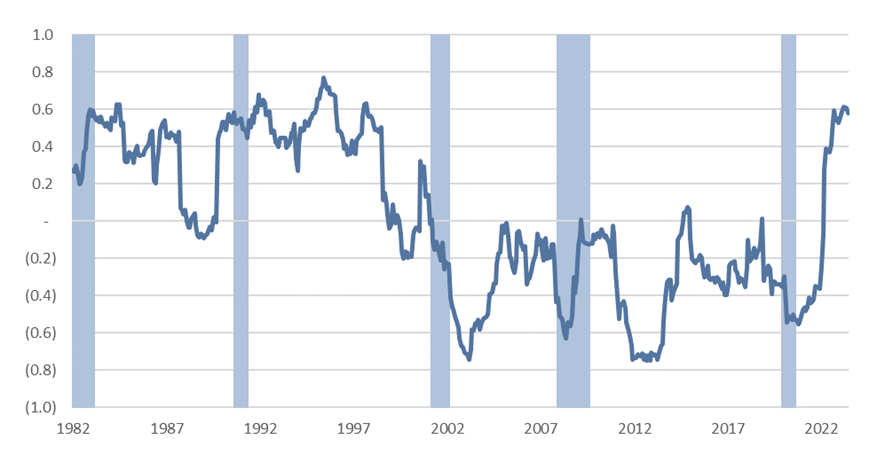

Aside from needing an increasingly urgent fiscal policy conversation in DC, what are the near-term implications for investors? I was discussing markets last week with some investors, and when the conversation turned to potential risks, someone quipped, “we don’t have to worry about bear markets anymore. Fiscal and monetary policy response means they are now over within a few months instead of a few years.” That sentiment was certainly true for the last two decades, but I wouldn’t rely on it going forward.

The Fed has yet to succeed in its fight against inflation, and there’s no fiscal space for Congress to dump additional dollars into the economy if something goes wrong. Emergency spending is the new baseline. Markets seem to understand that fiscal and monetary stimulus will not be the safety net it has been in the recent past — US stocks and bond markets remain positively correlated.

Fig. 2: Correlation of US Stock and Bond Markets

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.