Fed Rate Cuts – Not So Fast!

Last Week...

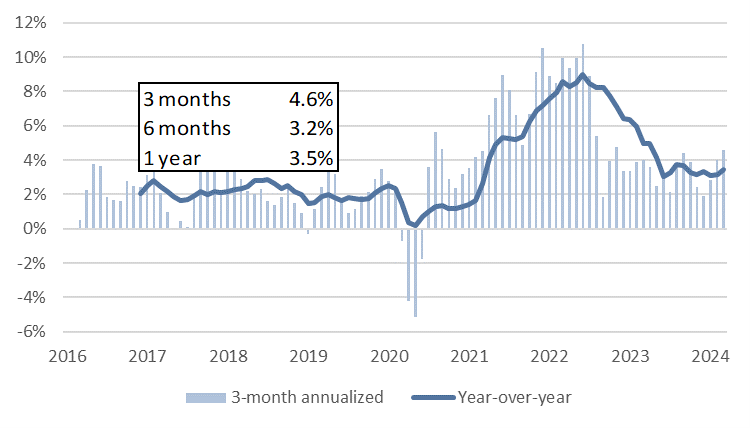

- The March headline Consumer Price Index (CPI) exceeded expectations, coming in at 0.4% compared to the consensus forecast of 0.3%. The annualized headline CPI rose to 3.5%, up from the previous month's 3.2% and surpassing the forecast of 3.4%.

- US equities concluded Wednesday's trading session with losses, although they recovered from earlier lows triggered by the CPI report. The Dow Jones, S&P500, and Nasdaq closed by 1.09%, 0.95%, and 0.84%, respectively.

- Market expectations for a rate cut in June fell to under 30% from nearly 60% before the release of the CPI data.

- FOMC minutes indicate the policy rate is at its peak, with policymakers favoring a slowdown in the pace of bond sales by around half.

- March headline Producer Price Index (PPI) registered at 0.2%, slightly below the consensus of 0.3% and February's figure of 0.6%.

Fed Rate Cuts – Not So Fast!

As measured by the consumer price index (CPI), inflation continues to remain stubbornly above the Federal Reserve’s 2% year-over-year target. The March CPI report released last week indicates that the cost of living rose 3.5% over the last 12 months and shows some signs of accelerating.

The inflation apologists continue to point to nuances around how the Bureau of Labor Statistics measures shelter prices as the reason inflation has remained sticky. They argue that rents, as measured by CPI, are lagged and that real-time measures show that rent growth has stalled across the US. Using real-time rents in CPI then results in a much lower CPI reading. It’s a fair critique of measuring rents, but CPI also doesn’t pick up the rising cost of owning a home due to higher home prices and borrowing rates. CPI is an imperfect measure, but it’s not obviously biased in one direction or the other.

Focusing on the components of inflation is missing the forest for the trees. In 2021, Fed Chair Powell pointed everyone toward “Supercore” inflation (CPI excluding goods and housing) when goods prices were rising rapidly. But now that Supercore inflation has surged to over 8% over the last three months, the Fed doesn’t talk about it much anymore.

Too-high inflation is a demand story (immigration, a balance sheet effect driving consumption, continued large fiscal deficits, etc). Aggregate demand (nominal GDP) is increasing by 6% per year versus a 4.5% trend pre-COVID. If the US economy can only grow at perhaps 2.5% in real terms, the rest of the excess demand will increase inflation. A 6% NGDP growth is commensurate with 2.5% real GDP growth and 3.5% inflation, which is exactly what we have today.

Fig. 1: Consumer Price Index (CPI)

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.