Five Charts to Remember 2025

Five Charts to Remember 2025

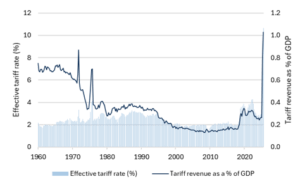

1. Tariffs: Liberation Day (April 2) pushed US tariff rates above post-WW2 levels. Tariff revenue is currently tracking at a 1% of GDP.

Fig. 1: Tariff rates and revenue, 1960-2025

Source: Federal Reserve Bank of St. Louis, Mill Creek. As of 12/23/2025.

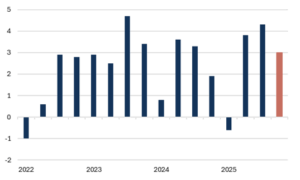

2. Economic growth: Buoyed by a resilient consumer and AI investment, US economic growth continues to defy many investors’ expectations (but not ours).

Fig. 2: Real economic growth accelerated in 2025

Source: Bloomberg, Mill Creek. Salmon bar is the Atlanta Fed GDPNow estimate for Q4 2025. As of 12/23/2025.

3. US dollar: During the first half of 2025, the dollar experienced one of its sharpest declines in 15 years. We expect further dollar depreciation in 2026.

Fig. 3: US Dollar Index (DXY)

Source: Bloomberg, Mill Creek. As of 12/23/2025.

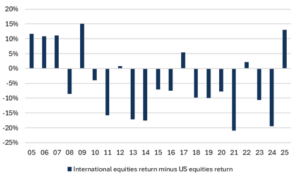

4. After 15 years of dominant US stock market performance, international stocks outperformed US stocks by the most since 2009.

Fig. 4: Calendar year international versus US equity performance

Source: Bloomberg, Mill Creek. As of 12/23/2025. Indexes are S&P 500 and MSCI ACWI ex USA.

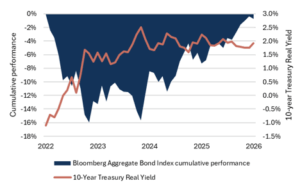

5. US bond portfolios produced mid-to-high single digit returns, erasing the remainder of 2022 losses. More importantly, inflation-adjusted yields haven’t fallen back to pre-COVID levels.

Fig. 5: US bond market performance and real yields

Source: Bloomberg, Mill Creek. As of 12/23/2025.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.