Full Steam Ahead for Private Credit

Last week, we attended a private credit conference. The event convened a diverse array of general partners and limited partners to discuss the latest trends shaping the industry. Overall (and not surprisingly), the group remains optimistic about opportunities and the return potential for private credit investments. However, they also acknowledged the likelihood of weaker economic conditions ahead. Below are three key takeaways from the conference:

- Bank Lending (Still) Under Pressure: The retrenchment by regional banks is substantial and here to stay. More stringent regulations proposed by the SEC are anticipated to take effect over the next few years. Additionally, banks are grappling with a declining deposit base, dicey exposure to commercial real estate, and unrealized losses on their balance sheets. These challenges have led most banks to curtail new deal origination, opening the door for private investors to fill the gap. At the conference, we heard several anecdotes of long-term bank clients being turned away for the first time and shifting to alternative financing options.

- Higher Quality Funding Opportunities: The current higher interest rate environment has enabled private lenders to finance more up in quality borrowers while still achieving their target returns of 8%-12%. Most opt to reduce risk in their portfolios rather than maximizing yield, anticipating a slowdown in economic conditions. Because most market participants, including private lenders, have been predicting a recession for the past 18 months, it has given the group ample time to firm up underwriting standards and selectively fund only the highest quality deals. We believe the extended runway to prepare will help certain managers avoid severe default and loss scenarios.

- Asset-Based Lending > Direct Lending: Direct Lending is the most familiar and adopted strategy in the private credit landscape. As our private credit white paper outlines, direct lending involves issuing first lien, senior secured floating rate loans to small and medium-sized companies. Repayment of the debt is reliant on cash flows generated from business operations, so corporate creditworthiness is the primary risk factor. Direct lending has accounted for roughly half of the total capital raised, mostly due to ease of scalability, access, and favorable return profile. However, the conference affirmed a trend we’ve noticed over the past 12 months. Allocators have reached their limits on direct lending/corporate credit exposure and are seeking other avenues to participate in the private credit space. Asset-based lending is now emerging as the preferred choice. Asset-backed loans are typically secured by hard assets such as machinery, real estate, aircraft, and infrastructure. They provide a partial hedge against inflation and de-risk over time due to amortizing debt profiles. We began actively deploying to the space in early 2021, so we believe the heightened interest should bolster our existing investments while offering new opportunities for capital deployment.

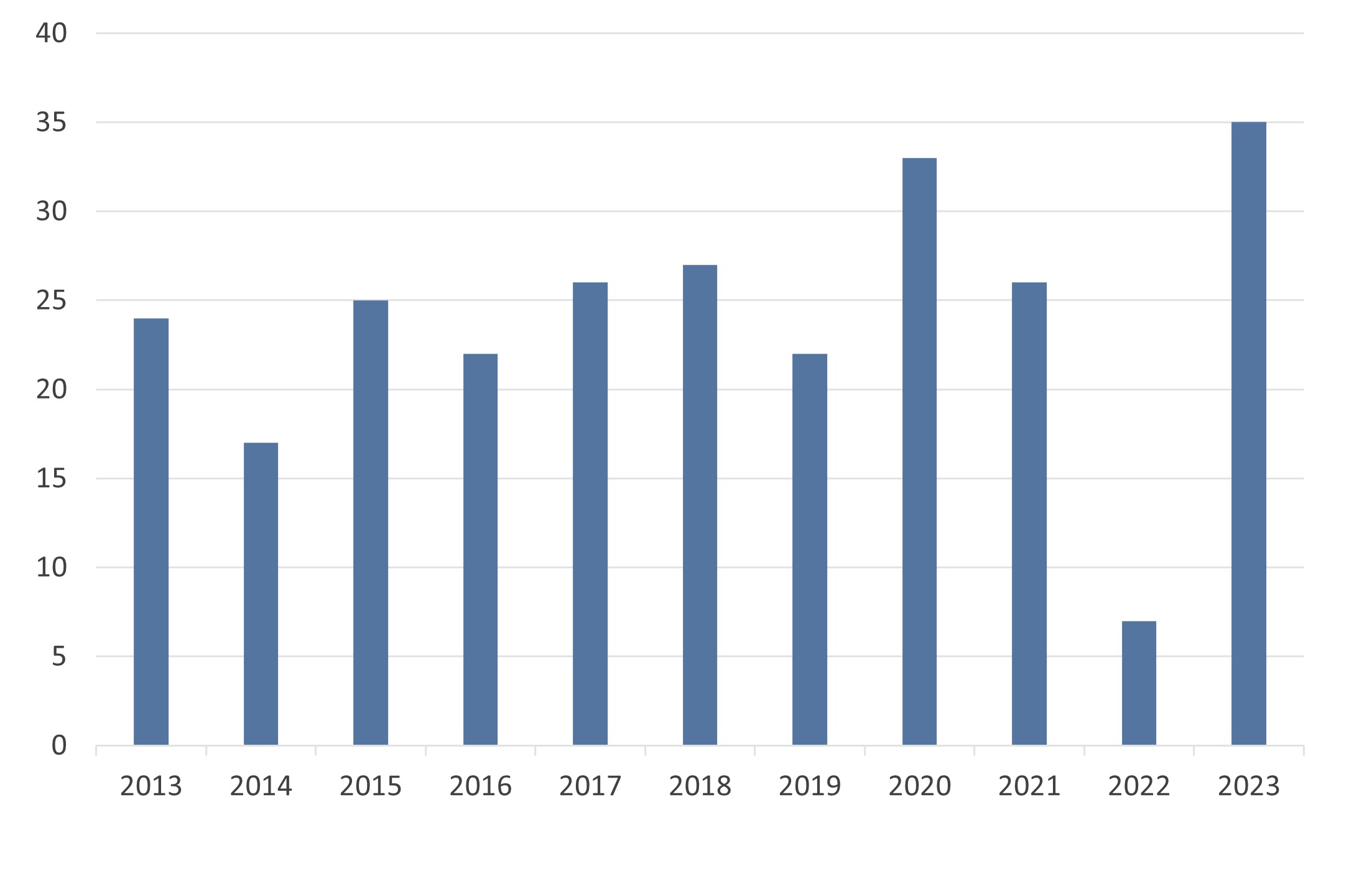

Fig. 1: Number of First Time US Private Debt Funds

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.