Has Artificial Intelligence Found Its Second Casualty?

Has Artificial Intelligence Found Its Second Casualty?

Source: Created by Mill Creek on 02/04/2026.

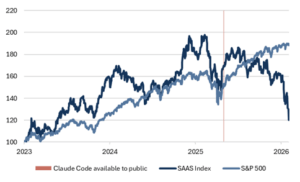

Underperformance of software-as-a-service (SAAS) companies, which has been ongoing since the release of Claude Code (an AI-powered coding software) to the general public in May 2025, accelerated last week (Fig. 1).

- Investors are concerned about the sustainability of subscription-based software businesses in a world where virtually anyone can vibe-code1 cheap and quick software solutions.

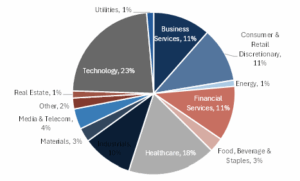

- Private credit is vulnerable to a downturn in software businesses. We have intentionally avoided software-backed private credit due to the (now obvious) risks from AI, but industry estimates put it at 25-35% of the private credit market (Fig. 2), particularly within technology and business services.

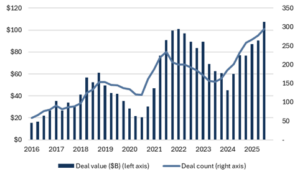

- Private equity is also exposed to software. SAAS buyout activity increased though 2025 in what could end up being a big misstep for the industry.

These risks notwithstanding, we don’t want to overstate the short-term impact of AI on software usage. Last week, Nvidia CEO Jensen Huang called the notion that AI will replace software “the most illogical thing in the world, and time will prove itself.” It will take many months, or more likely years, for AI-native enterprise software replacements to be developed.

1 Vibe coding is using AI to build software by describing what you want in plain English rather than coding line by line.

Fig. 1: SAAS has underperformed the broad market

Source: Bloomberg, Mill Creek. Data as of 02/03/2026.

Fig. 2: Direct lending industry composition

Source: Cliffwater, Mill Creek. Data as of 12/31/2025.

Fig. 3: SAAS buyout deal activity (trailing 12 months)

Source: Pitchbook, Mill Creek. Data as of 09/30/2025.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.