Implications of a Federal Government Shutdown

As of 10 am on Friday, September 29, 2023, an October 1st federal government shutdown appears inevitable. If a shutdown occurs, federal functions deemed non-essential will be suspended, whereas those deemed essential will continue. Neither essential nor non-essential employees will receive paychecks during the shutdown.

Axios provides a good summary here. Of particular note is the National Flood Insurance Program. Funding for the program will expire on October 1st and the National Flood Insurance Program has said they cannot issue new policies during a shutdown.

We don’t anticipate a shutdown prompting any changes to our investment recommendations at the current time. Shutdowns can result in short-term equity market volatility, but have not historically resulted in sustained market impact. For now, interest rates and corporate earnings are moreimportant drivers of equity market returns.

The immediate economic impact of a shutdown will be a modest drag on GDP growth, but federal employees will receive back pay once the shutdown is resolved. Historically, the overall impact on economic growth from shutdowns has been nil – the initial drag is offset by catch-up growth once

backpay is received.

What is more concerning to us is that the shutdown, and resulting lack of real-time economic data, will come at a tenuous time for monetary policy. While the Federal Open Market Committee (FOMC)continues to pencil in a December rate hike in their Statement of Economic Projections (SEP), their ongoing commentary betrays a bias to remain on hold into 2024.

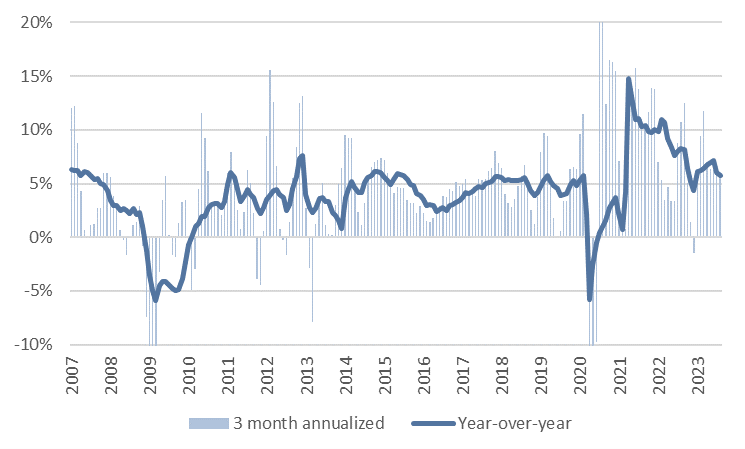

A shutdown enables the Fed to lean into this dovish perspective, even though it is clear (to us at least) that economic growth reaccelerated in Q3. For example, we received confirmation today that aggregate incomes continue to grow at a rate incommensurate with 2% inflation (Fig. 1). An extended shutdown

could mean that the Fed (once again) falls behind the curve and, by the time they realize it, must hike two or three more times in 2024 when once would have been sufficient had they moved in 2023.

Fig. 1: Aggregate income growth remains above the 4-4.5% level commensurate with 2% inflation.

As of 10 am on Friday, September 29, 2023, an October 1st federal government shutdown appears inevitable. If a shutdown occurs, federal functions deemed non-essential will be suspended, whereas those deemed essential will continue. Neither essential nor non-essential employees will receive paychecks during the shutdown.

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.