Investment Implications of Powell’s Jackson Hole Speech

Investment Implications of Powell’s Jackson Hole Speech

Fed Chair Jerome Powell gave his final keynote address at the Federal Reserve Bank of Kansas City’s annual symposium held in Jackson Hole, Wyoming, on August 22nd. Markets interpreted Powell’s speech, titled “Monetary Policy and the Fed’s Framework Review,” in a dovish fashion, meaning that they expected the Fed to lower policy rates more at the end of the speech than they did before he started talking. Treasury yields fell, equity markets and gold rallied, and the dollar fell.

In this article, we have pulled out what we believe are the most important aspects of his speech for investors. For clarity, his comments are in italics below.

Powell on the labor market (emphasis ours):

But it does not appear that the slowdown in job growth has opened up a large margin of slack in the labor market… The unemployment rate, while edging up in July, stands at a historically low level of 4.2 percent and has been broadly stable over the past year… it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment.

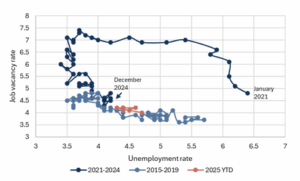

One way to visually see shifting labor supply and demand is the Beveridge curve, which we included in our Q2 outlook this year. This curve indicates that supply and demand in the labor market remain balanced from a historical context. Downside risks might be rising, but they are hard to spot in the broad labor market data.

Fig. 1: Beveridge curve

Source: Bloomberg, Mill Creek.

Powell on inflation:

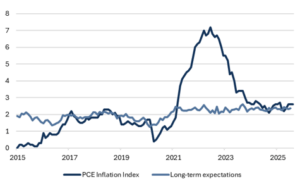

Turning to inflation, higher tariffs have begun to push up prices… The question that matters for monetary policy is whether these price increases are likely to materially raise the risk of an ongoing inflation problem… Measures of longer-term inflation expectations, however, as reflected in market- and survey-based measures, appear to remain well anchored and consistent with our longer-run inflation objective of 2 percent.

Should we read this as an abandonment of the 2% inflation target? If inflation has yet to return to 2%, and tariffs are pushing inflation higher, can the Fed really point to long-term expectations and declare that all-is-well? The Fed used inflation expectations as a reason to not be worried about rising inflation in early 2021 and it led to the worst inflationary episode in 50 years.

Fig. 2: Inflation expectations and actual inflation (%)

Source: Bloomberg, Mill Creek.

Powell on the future of monetary policy:

…the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.

This is how a central banker emphatically tells the market that rates cuts are coming. The market is now pricing in two cuts by the end of this year and three more cuts next year.

Our perspective

We believe Powell is on thin ice with his argument for lowering policy rates. As more Federal Open Market Committee (FOMC) members signal their desire for rate cuts, Powell has decided to make a monetary case (i.e. inflation and employment) that the Fed funds rate is restrictively high and can be lowered without stoking inflation. This shift in positioning fits neatly alongside the Trump administration’s fiscal case (i.e. interest costs are too high) [see our recent coverage here] for policy rate cuts, but creates plausibility that the Fed is cutting for economic instead of fiscal reasons.

We don’t believe monetary policy is currently restrictive. The Atlanta Fed’s real-time GDP tracker estimates 3.5% GDP growth in the third quarter, which is at or above full potential for the US. The labor market is slowing, but slowing isn’t the same as weakening. Historically high levels of deficit spending continue to provide fiscal stimulus to the economy and we see virtually no signs of stress within financial markets. Even so, policy rate cuts appear to be a foregone conclusion.

The backdrop of healthy earnings growth (consensus estimate is +11.2% for the next 12 months) and lower policy rates is bullish for risk assets and bodes well for equity markets. The medium-term risk, as we see it, is that sticky inflation will eventually push longer-term Treasury yields higher or force the Fed to pull back on rate cuts, which would create a headwind for the risk-on environment we’ve experienced since mid-April.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.