It Was the Best of Times, It Was the Worst of Times…

November 2023 was one of the best months in the last 40 years for investors holding balanced portfolios of stocks and bonds. Declining interest rates pushed bond prices up, resulting in the best monthly return for the Bloomberg Municipal Bond Index since 1982 and the best monthly return for the Bloomberg US Aggregate Bond Index since 1985. Lower interest rates also contributed to a significant loosening of financial conditions, which led to a jump in equity prices.

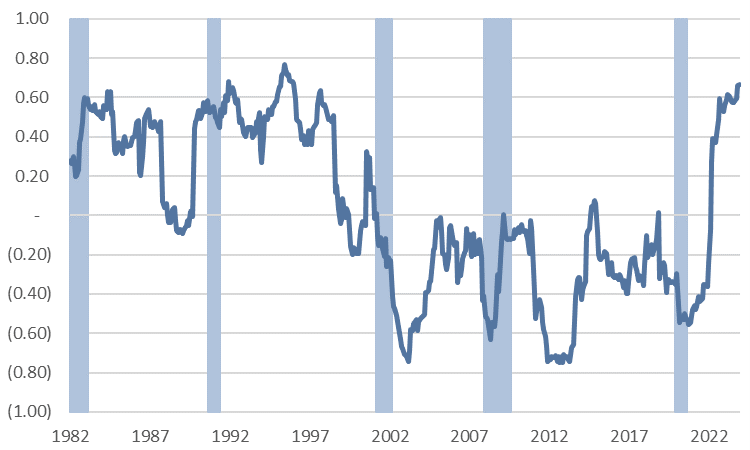

However, the other side of the “best single month return since the 1980s” coin is a stark reminder of how correlated stocks and bonds are right now (Fig. 1). Investors typically hold a balanced portfolio of stocks and bonds on the premise that they will provide some level of diversification to each other. They expect that bonds will go up when stocks go down and vice versa.

Stock/bond diversification worked well for investors between 2000 and 2022, but stocks and bonds didn’t provide much diversification benefit in the 1980s or 1990s. While the 1980s comprised less than a quarter of the 43-year period we’re discussing, 75% of the best and worst months came during that decade. Today, stocks and bonds are once again trading together rather than providing the intended diversification within a portfolio. In recent months, they are starting to show up in both the best and worst columns for stock/bond portfolios.

Fig. 1: 24-Month Rolling Correlation, S&P/Treasury Bonds

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.