May 2024 Update: Is the Labor Market as Strong as the Data Suggests?

Last week...

- Powell maintains optimism, but recent inflation and wage data suggest that interest rates might need to remain high, as inflation stabilizes around 3%.

- Large banks have maintained high reserve levels against office loan losses, preparing for potential future impacts from commercial real estate downturns without significant current earnings hits.

- Rising inflation and increased government spending are elevating U.S. debt yields and prompting a bond market sell-off, with the Fed maintaining high interest rates and the Treasury planning to issue $1 trillion in bonds.

- US stock indexes closed April with significant losses, with the Dow experiencing its worst month since September 2022.

- Hong Kong's economy grew 2.7% in the first quarter of 2024, surpassing expectations due to strong exports.

Fed Chair Jerome Powell used the May 1st Federal Open Market Committee (FOMC) press conference to (1) reinforce that a hike remains unlikely as the next policy move and (2) communicate that an eventual rate cut could be pushed well into the second half of this year. While the Fed remains “data dependent,” they’re really hoping they can outlast the recent inflation data that suggests the path back to 2% might take longer than they would prefer.

During the press conference, Jennifer Schonberger, a reporter with Yahoo Finance, asked Powell, “Would the unemployment rate popping back above 4% catch your attention?” Powell responded: “You know, I said an unexpected weakening is the way I characterize it. So, and I’m not going to try to define exactly what I mean by that. But, it would be, it would have to be meaningful and get our attention and lead us to think that the labor market was really significantly weakening for us to want to react to it.”

The labor market is an interesting topic right now because while I’m typically dismissive of claims that our economic data is untrustworthy, the large influx of migrants and slow recognition of that population growth by federal agencies over the last three years has created challenges for interpreting labor market data. For example, in January of 2022, it seemed inconceivable that we would experience monthly job growth of 315,000 for 2022 and 2023, but those numbers make more sense when one considers that it’s likely that 8 million immigrants entered the country over that period.

This week, our commentary takes a look at the current state of the US labor market from various perspectives and finds that while it remains strong, we have seen recent softening that supports Powell’s wait and see approach to the economy.

Unemployment Rate

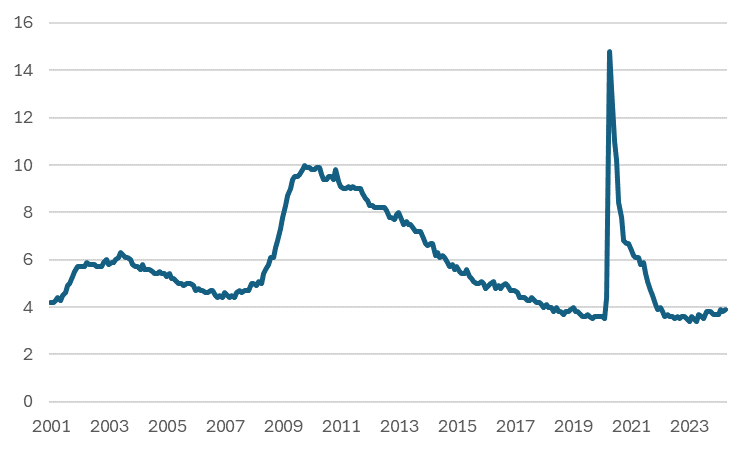

The US unemployment rate fell to what will likely be a cycle low of 3.4% in January 2023 and currently stands at 3.9% (Fig. 1), which is low from a historical perspective and only slightly above the 3.6% unemployment rate we had achieved in 2019 before COVID. While 3.9% would be a celebrated economic achievement for any Fed Chair, the increase in the unemployment rate can be a harbinger of recession – hence the question for Powell referenced above.

Economist Claudia Sahm is well known for what we call the Sahm Rule. Historically, it has been possible to identify the start of a recession when the three-month moving average of the unemployment rate rises by 0.5 percentage points or more relative to its low over the last year. The current “Sahm Rule” measure is 0.37, which is important because it indicates that the rise in unemployment rate has been slow enough to not be an indicator of recession right now.

Fig 1: Unemployment Rate (%)

Job Openings and Voluntary Quits

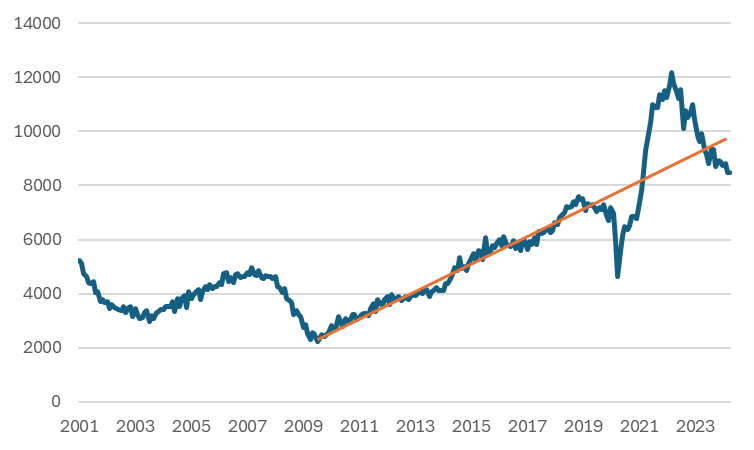

The so-called JOLTS report (Job Openings and Labor Turnover) report gives us two important indicators of labor market health. The first is total job openings, which skyrocketed in 2021 but have since moderated. While total job openings remain high versus history, they have fallen below the 2009-2019 trend. We don’t have a great explanation for why job openings have increased steadily, but it could simply be a measurement issue related to the ease of posting jobs electronically in multiple places. Our view is that the job opening numbers no longer indicate an overly hot hiring environment and could possibly stabilize at the current level.

Fig 2: Total Job Openings (thousands)

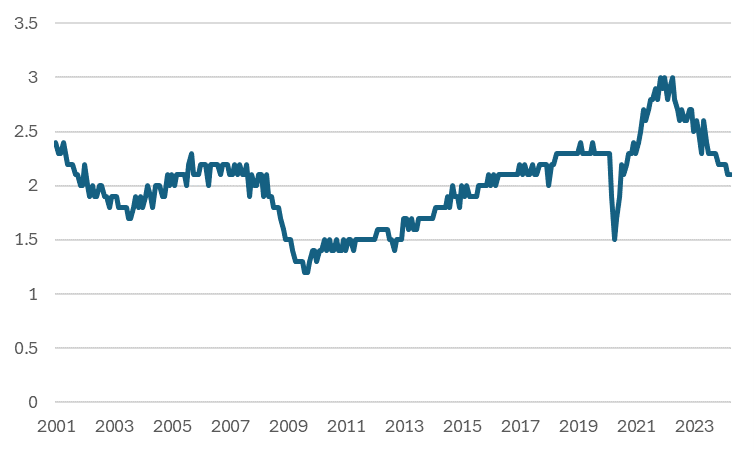

The quits rate (Fig. 3) is, in our opinion, a more important indicator. The quits rate measures the percentage of employees that voluntarily quit in any given month – a indicator of their prospects elsewhere and potential earnings pressure of firms trying to retain workers. The current quits rate, 2.1%, is in-line with the strong but not overheating labor market we experienced from 2016-2019.

Fig 3: US Quits Rate (%)

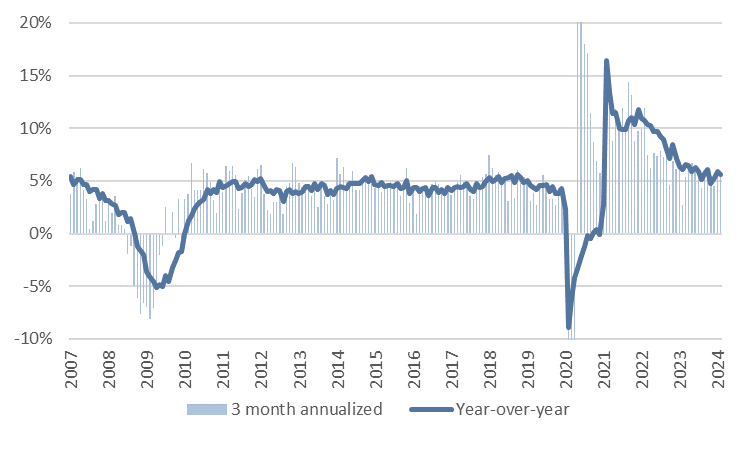

Wage Growth and Aggregate Income Growth

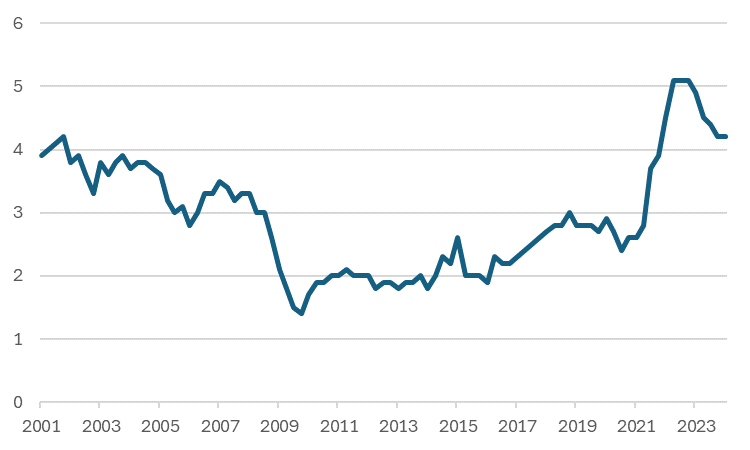

Wage growth and aggregate income are the final aspects of the labor market worth considering. For wage growth, the Fed focuses on the Employment Cost Index (ECI) (Fig. 4), which is a measure of total employee compensation based on a quarterly survey by the Bureau of Labor Statistics. The ECI has moderated but is still rising at an annualized rate of 4.2%. The Fed believes an ECI of 2.5-3.5% is more in-line with a 2% inflation target.

Fig 4: Employment Cost Index (%)

Aggregate income growth is a measure of the total amount of income US households take home. Aggregate income could increase due to wage growth or the creation of a new job and serves as an indicator of the overall health of the economy. Importantly, a decline in aggregate income can lead to a severe recession as households no longer have the income necessary to pay mortgage or auto loans. Currently, aggregate income growth remains higher than what we experienced between 2013-2019, but has fallen enough to be well within a “soft-landing” outcome.

Fig. 5: Aggregate Weekly Payroll Growth

In conclusion – the labor market has slowed from what could be called overheating to simply “solid.” Like Powell, we’ll be watching all of these indicators for signs of further slowdown. For now, its fair to conclude that the Fed remains on a soft-landing path over the next 12-18 months.

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.