Navigating Crisis Insights and Market Resilience

One of the least enviable aspects of my job comes from the necessity of providing economic and investment commentary around human tragedies. 9/11, Hurricane Katrina, COVID-19, and Russia’s invasion of Ukraine come immediately to mind. Now, we must consider the terrorist attacks, and ensuing conflict, on Israel by Hamas.

Today’s commentary is split into two parts. First, I attended a timely conversation with two former US National Security Advisors, Ambassador John Bolton (Trump) and General James Jones (Obama), at the Yale Club last week in NYC. Both were unified in their sharp critiques of US foreign policy, and the first section summarizes their comments. The second section provides our perspective on the current and potential market impact from the attacks on Israel.

Foreign Policy

Ambassador Bolton started by saying that he believes we have moved out of the “post-Cold War” era that began with President George H. W. Bush and are now facing a long 21st-century struggle against a new axis power centered around Beijing and Moscow. General Jones agreed and added that the last 40

years of appeasement to authoritarianism (e.g. allowing China to steal American intellectual property, Obama and Biden’s handling of the Nuclear deal with Iran, and the chaotic withdrawal from Afghanistan) have been interpreted as weakness and emboldened our advisories overseas.

Both Ambassador Bolton and General Jones also expressed conviction that Iran was likely behind the recent terrorist attacks in Israel. Ambassador Bolton added that the Biden administration has been hesitant to discuss Iran in regard to the attacks by Hamas because then “they would have to do something about it.” For what it is worth, both also believe that the Iranian regime is very fragile and would crumble quickly if outside pressure, instead of appeasement, was provided to help internal dissidents.

Finally, both agreed that it is too early to have confidence around any fallout from the Israeli war with Hamas, but Ambassador Bolton added, “the possibilities are all dangerous.”

Market Perspective

The global economic and market impact from the attacks on Israel was negligible over the past week.After a mild risk-off reaction (equities down, bonds up, oil up) last Monday, global markets were stable through the remainder of the week. Oil prices finished the week about 4% higher. The local financial market impact was not as sanguine. The TA-125, an index that tracks the 125 largest stocks traded on the Tel Aviv exchange, fell 6.5%, and the shekel declined 3.3% against the US dollar during the week. Our investment portfolios have very limited exposure to the Israeli market.

From a market standpoint, we agree with General Jones and Ambassador Bolton that we are in the very early stages of understanding the potential fallout in the Middle East. A contained confrontation between Israel and Hamas would likely lead to minimal global market impact (as distinct from the local market impact) as investors focus on geopolitical tensions, ala Russia and Ukraine, generally declines quickly. However, regional escalation could have far-reaching consequences.

For example, a sustained regional conflict would likely exacerbate an already undersupplied oil market. Crude exports from Iran are running at about 1.5 million barrels per day, and stricter enforcement of current US sanctions could remove some of that capacity from global markets. More consequentially, regional escalation might result in the destruction of oil infrastructure or the blocking of the Straight of Hormuz. For the time being, OPEC+ members have committed to maintaining stability in the oil market and have the spare capacity necessary to do so, but that posturing could change.

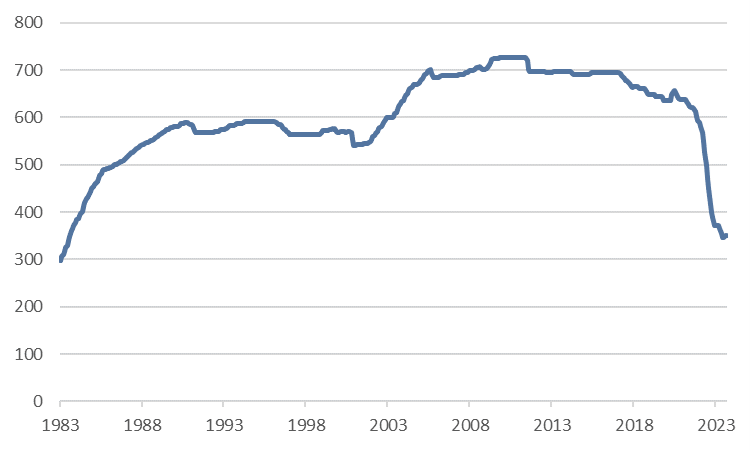

The US Strategic Petroleum Reserve (SPR) has historically been used to offset global supply disruptions (e.g. Libyan civil war in 2011, Hurricane Katrina, Operation Desert Storm) and could be used to mitigate price challenges, on the margin, if needed due to the current conflict. However, the SPR has been drawn down to 351.3 million barrels of oil (its lowest level since 1984), against a capacity of 714 million barrels, over the last two years (Fig. 1).

From an asset allocation perspective, we remain neutral on equities, underweight fixed income, and overweight private credit. The current bout of risk aversion could very well lead to a short-term decline in bond yields, but as last week’s hotter-than-expected Producer Price Index data indicates, upward pressure on rates remains likely for a 6-12 month horizon. While we are confident in our current positioning, we will be proactive in making and communicating changes as conditions dictate.

Fig. 1: Strategic Petroleum Reserve

This commentary is divided into two parts. The first part recounts an insightful discussion CIO Michael Crook attended with two former US National Security Advisors, Ambassador John Bolton (Trump) and General James Jones (Obama), held at the Yale Club in NYC last week. They both offered cohesive critiques of US foreign policy, and the initial section outlines their viewpoints. The second section offers our analysis of the present and potential market repercussions stemming from the attacks on Israel.

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.