Last Week...

- The US saw a job slowdown in job growth, with only 175,000 jobs added in April, falling short of expectations, and the unemployment rate increased slightly to 3.9%.

- Ahead of the April CPI data due on May 15, bond volatility has declined, and short positions in Treasury futures remain extended.

- US companies are increasing their share buybacks, demonstrating confidence in their financial health and prospects, with notable increases by tech giants such as Meta and Apple.

- The Bank of England maintained its key interest rate at 5.25%, a 16-year high, but suggested potential rate cuts soon to align with actions by other European Central Banks.

It’s no secret that private credit’s growing popularity has come at the expense of traditional banks. As more companies opt to secure funding through alternative sources, banks lose out on lucrative deal fees and revenues from ancillary services. To counter some of these mounting pressures, banks have increasingly embraced strategic partnerships with their competition. Just last week, PNC Bank and TCW Group, a $200 billion asset manager, announced they are teaming up to expand each other’s private credit capabilities. In this joint strategy, TCW will oversee loan origination, underwriting, and portfolio management, while PNC will tap its network to source opportunities. Specific terms of the deal remain undisclosed, but it’s probable that PNC will receive a share of the GP economics associated with the newly formed private credit platform while avoiding the necessity to lend off its own balance sheet, a near impossibility in today’s strict regulatory environment. Other recently announced cooperation agreements include Barclays and AGL Credit Management, Wells Fargo and Centerbridge, and Citibank and LuminArx.

Who comes out ahead? We are still in the early innings of these alliances, and there seem to be clear benefits for both parties. However, we believe private credit platforms ultimately get the better deal from a competitive standpoint. They access valuable new sourcing channels, grow AUM and enjoy increased revenues from management and incentive fees. Indeed, banks diversify their revenue streams and can leverage their broader suite of services to boost margins. But their push into private credit comes from a defensive posture, reacting to shrinking market share, driven by regulatory constraints and challenging operating conditions. A tough backdrop to innovate and keep up with markets participants’ evolving needs. Nevertheless, these new partnerships suggest that banks and private lenders will push the industry forward, spurring growth and fierce competition across this area of alternative finance for the foreseeable future.

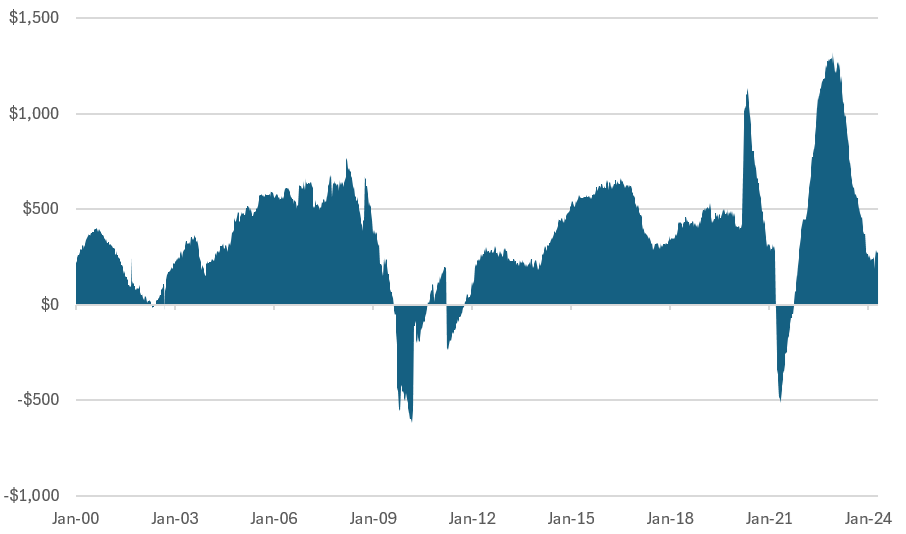

Fig. 1: Loans and Leases Change from Year Ago (Billions), All Commercial Banks

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.