November 2024 Update: Staying Steady Amid the Election Frenzy

Sometime within the next week, we will (hopefully) know the winners of the US elections. We recognize that regardless of the outcome, roughly half of our readers will be disappointed. Our message this week is to be patient and not let the election drive rash investment decisions. Economic fundamentals are likely to be the primary driver of market performance in the near term.

Some commentators will go further and suggest that investors can completely ignore Washington DC. We’re not that flippant; there are countless historical examples of presidential actions resulting in positive and negative reactions on Wall Street, including Theodore Roosevelt’s anti-trust action against Northern Securities in 1902, Herbert Hoover’s fiscal restraint in the early days of the Great Depression, and Richard Nixon’s wage and price controls (1971).

Our view is that elected officials, our political institutions, and policy decisions matter for investors. All three will have an impact on our investment decisions. Most of next year will be focused on negotiating modifications and extensions to the 2016 Tax Cuts and Jobs Act, which expires at the end of 2025. We can afford a wait-and-see approach to what is prioritized in DC post-election.

Financial conditions remain positive

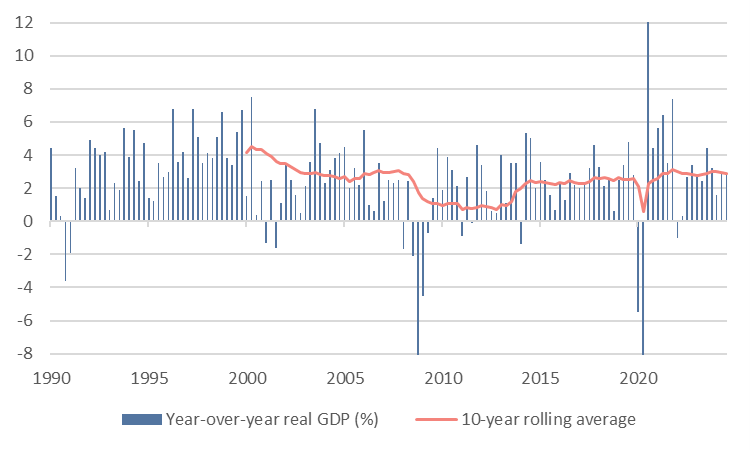

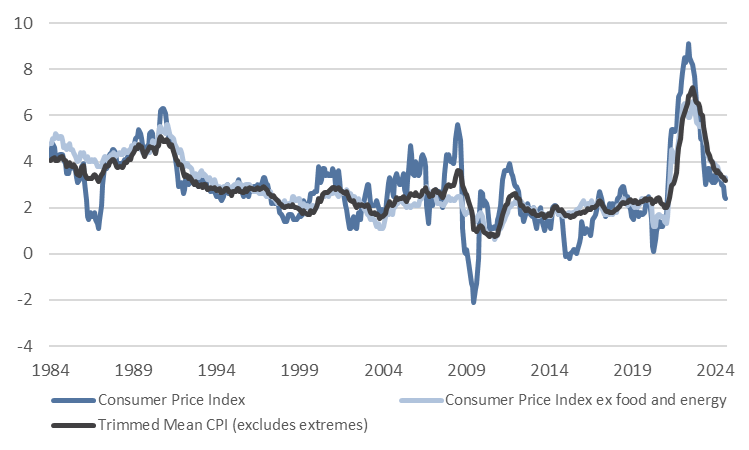

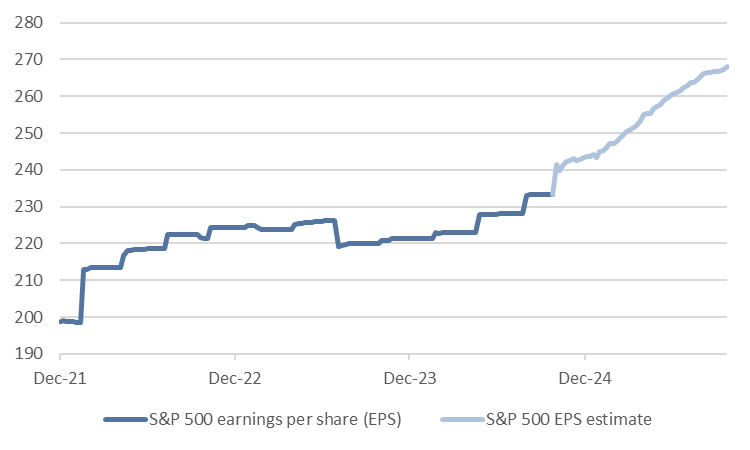

The US economy remains on solid footing. Economic growth remains above average (Fig.1) and inflation has moderated (Fig. 2) to the extent that the Federal Reserve has begun lowering policy rates. An accommodative Federal Reserve provides an attractive backdrop to sustain the rally in risk assets, particularly since corporate profits have begun growing again after stagnating from mid-2022 to mid-2024 (Fig. 3).

Fig. 1: US GDP Growth

Source: Bloomberg, Mill Creek.

Fig. 2: Inflation

Source: Bloomberg, Mill Creek.

Fig. 3: S&P 500 earnings

Source: Bloomberg, Mill Creek.

The main short-term risk to the bull market, in our estimation, is not the election but a recalibration of Fed policy by market participants. Absent a recession, aggregate household income growth simply remains too high for the Fed to cut policy rates to 3.5%, as has been priced into the Treasury market, by December of 2025. We expect this recalibration, which has already started, to eventually happen regardless of who wins on November 5th.

Market considerations leading into the election

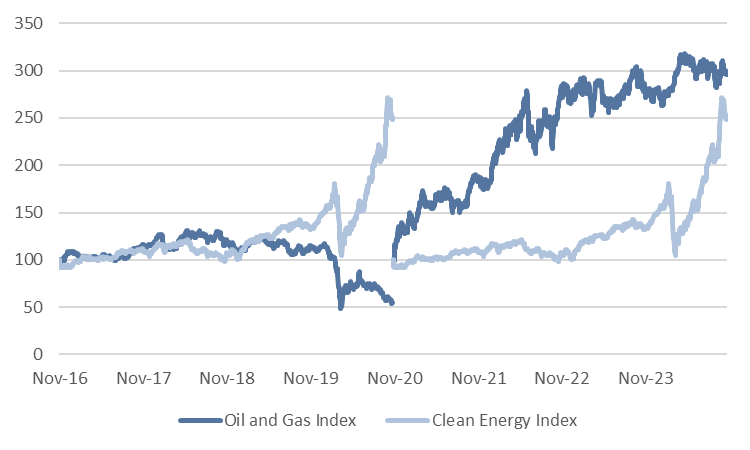

We have refrained from publishing all-too-typical election commentary that tries to distill vague campaign trail promises into specific investment advice. The performance of green energy and traditional oil and gas during the last two administrations (Fig. 4) provides a good counterbalance to the “Trump or Harris will be good for XYZ sector” commentaries. Green energy significantly outperformed traditional energy under Trump and underperformed traditional energy under Biden. The number of equities strategists on Wall Street who called that trade correctly is approximately zero.

Fig. 4: Energy sector performance

Source: Bloomberg, Mill Creek.

Presidents set the DC agenda and nudge Congress towards legislative priorities, but economic trends and market forces frequently overwhelm political desires.

In case you missed it, please see our Q4 2024 Outlook: Deficits, Debt, and Inflation for a deep dive into the U.S. fiscal outlook.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.