November Update: Was 5% the Peak for Interest Rates?

Executive Summary

- Last week, the 10-year Treasury Note briefly reached 5% interest rate, a level not seen since 2007, before retracting to 4.8%. The question arises as to whether 5% marks the peak for this rate cycle.

- While technical factors may lead to short-term pauses or retracements in yields, the underlying fundamentals driving higher rates remain in place.

- A relief rally is anticipated, with rates potentially stabilizing around the 5% mark. This is partly attributed to the round number bias observed in human behavior, where significant thresholds like 5% tend to have psychological impact.

- Negative sentiment and speculative short positions among traders suggest potential for profit-taking as rates approach 5%. Non-speculative investors, such as pensions and retirees, are expected to contribute to near-term demand for bonds.

- Despite near-term challenges, the current economic strength and a perception that the Fed's efforts to combat inflation are insufficient are likely to sustain elevated yields in the foreseeable future. Fundamentals continue to favor higher interest rates, aligning with economist Milton Friedman's unconventional insight on the relationship between interest rates and monetary policy.

Last week, the market interest rate on the 10-year Treasury Note briefly hit 5% for the first time since 2007, before quickly falling back to 4.8% (Fig. 1). Did 5% represent the peak in long-term interest rates for this cycle, or do rates have further to go?

While technical factors could lead to a brief pause or even retracement in yields, the fundamental factors that have been pushing rates higher remain in place.

Fig. 1: 10-Year US Treasury Yield

A relief rally is overdueWe would not be surprised to see rates temporarily stabilize near 5%. There’s a behavioral finance concept known as the round number bias that suggests humans have a preference for round numbers. For example, 40th birthdays tend to be more celebrated than 39th or 41st birthdays. In baseball, there are more players who hit .300 in a season than those who hit .299. This is likely because they take games off once they reach .300 near the end of the season. Marathon runners are much more likely to finish at 3 or 4-hour cutoffs than five minutes later. Even well-known investors like Bill Ackman and Bill Gross publicly cover their bond shorts at 5% instead of 4.9% or 5.1%. Investor sentiment around bonds has been very negative this year, and Commodity Futures Trading Commission (CFTC) data indicates traders continue to hold a large speculative net short position (they expect rates to go higher). With 10-Year Treasury yields nearing 5%, it is likely high enough for many traders, like Ackman and Gross, to reduce their short positions and book profits. We believe that non-speculative investors, like pensions and retirees, will also provide a source of demand in the near term. The top 100 private corporate pensions in the US went from an 18% funding shortfall in 2020 to a 3% funding surplus today. Fiscal prudency should drive those pensions to immunize their future liabilities by selling risk assets (equities, hedge funds, etc.) and purchasing bonds that match their future cash flow needs. Despite these near-term headwinds for interest rates, our view remains that current economic strength, combined with a market perception that the Fed has not done enough to combat inflation, will keep yields elevated around current levels for the foreseeable future.

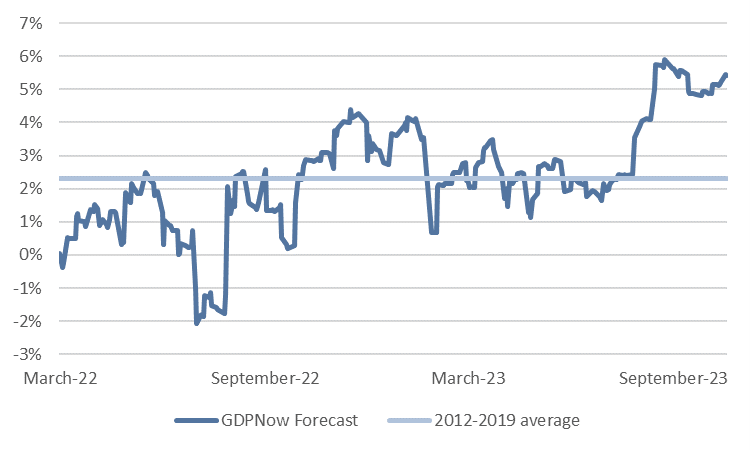

Fundamentals remain biased to higher ratesIn 1968, economist Milton Friedman wrote something that went against the prevailing view at the time and remains counterintuitive for many investors. He said: “As an empirical matter, low interest rates are a sign that monetary policy has been tight… high interest rates are a sign that monetary policy has been easy…” He was referring to long-term interest rates like the 10-year Treasury, not the short-term interest rate that the Fed controls directly. In other words, a 1.5% 10-year Treasury in 2016 reflected that eight years of post-GFC monetary policy had actually been too restrictive, whereas a 10-year Treasury at 5% means the Fed hasn’t been overly tight today. Current data supports Friedman’s insight. The Fed has engaged in one of the fastest hiking cycles in central bank history, but economic growth remains resilient (Fig. 2) and is now higher than it was when the Fed began the hiking cycle in March 2022. Inflation expectations have also been rising, not falling. Outside of a few highly interest-rate-sensitive sectors (e.g. commercial real estate, US regional banks) and countries (e.g. Canada, UK), there are few signs of tight monetary policy in the current market. |

Fig. 2: Atlanta Fed GDPNow Forecast

Nearing an inflation point

Our Q4 Outlook, “The Old Normal,” said, “It is too early to fall for the siren song of higher bond yields.” Although the 10-year Treasury yield is 0.5% higher than when we wrote those words, our positioning remains the same… for now. Our base case outcome is for resilient economic growth and stubborn inflation to push US Treasury rates to 5% or above by early 2024, but we also recognize that there will come a time to turn defensive. In addition to monitoring the health of the labor market and residential investment, we’re looking for spillover from the interest rate-sensitive parts of the economy and investment universe as an indication that elevated rates are finally having a contractionary effect on the economy. We’ll write more about those potential sources of contagion in our weekly commentaries as we head into year-end.

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.