Potential Liquidity Opportunities in 2025

Potential Liquidity Opportunities in 2025

The private equity landscape has faced several challenging years regarding liquidity options, particularly for large or technology-oriented assets. PitchBook has identified numerous private equity-backed companies, including well-known names like Stripe, SpaceX, and Databricks, as potential IPO candidates heading into 2025.1

Corporate M&A markets have also shown some recent activity, but mixed signals persist. While 2025 could present opportunities for liquidity in private equity, it is important to remain cautious of potential headwinds, including inflationary pressures, tariff changes, and labor force disruptions. We believe investors should consider these factors carefully as they assess the evolving market dynamics.

[1] PitchBook, 10/31/2024.

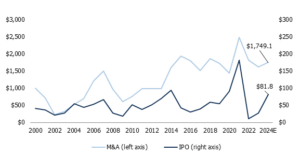

Fig. 1: IPO markets are poised for a recovery

US M&A value and IPO capital raised ($B)

Source: PitchBook, 10/31/2024.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.