Round Trip

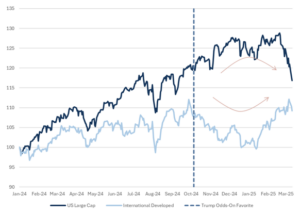

Market action over recent weeks has reversed the exuberance observed once President Trump became the front runner – and eventual winner – of last year’s presidential election. Investors appear to be reassessing the impact that the White House’s agenda may have on the economy and markets and equity markets have reverted back to levels seen in late September/early October 2024. Incidentally, this was roughly the same time as when Trump became the odds-on favorite to win the presidency.

Fig. 1: Markets Reverse Course

Source: Bloomberg, Polymarket, Mill Creek.

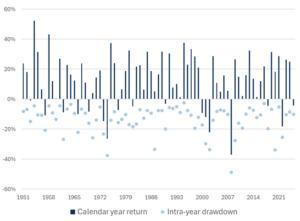

While the recent market decline in US equities has been disconcerting for many investors, it also provides an opportunity to reset expectations. Intra-year declines of 10% are normal occurrences for equity markets (Fig. 2). Investors that are underweight their target equity positions can use it as an opportunity to accelerate a dollar cost averaging program, but the overall attractiveness of US equities hasn’t changed appreciably due to the decline.

Fig. 2: S&P 500 calendar year returns and intra-year declines

Source: Bloomberg, Mill Creek.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.