Signs of Life in Fintech Market

Signs of Life in Fintech Market

For over a decade, financial technology (aka Fintech) companies have attracted considerable capital and attention from the global venture capital (VC) community and have, effectively, created a new industry within the broader financial services sector. Driven by mobility, cloud services, and the severe limitations of regulated incumbent financial institutions, start-up companies have created innovative business models and substantial market capitalizations. The industry is tracked as its own vertical and includes sub-sectors such as neobanks, wealth tech, alternative lending, decentralized payment networks, etc.

We are highlighting the sector this week as a flurry of noteworthy events have taken place signaling a revival in an area that is an important part of venture capital. These include:

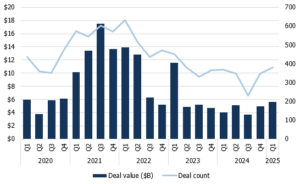

Despite operating across distinct verticals, trading, crypto, and digital banking, these firms illustrate a synchronized rebound in investor appetite for fintech (Fig. 1) and 1Q 2025 has been a period of positive momentum for the sector. There have also been a number of noteworthy private financing events of scale. For investors, we would expect this trend to continue as banking, payment, and investment management services will continue to be impacted by fintech innovations.

Fig. 1: Fintech deal activity is showing signs of life

Enterprise fintech VC deal activity by quarter

Source: PitchBook, Q1 2025 Enterprise Fintech VC Trends report. Data as of 3/31/25.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.