Supply-side Economics Makes a Comeback

Last Week...

- Central banks are expected to increase their gold reserves amid growing pessimism about the U.S. dollar, driven by economic and political uncertainties, according to the World Gold Council.

- Global stocks were mixed on Wednesday, with U.S. index futures fluctuating after Nvidia became the most valuable listed U.S. company.

- The U.S. national debt is projected to surpass $56 trillion by 2034, with rising deficits and upcoming legislative battles over tax cuts and the debt limit.

- U.K. inflation slowed, raising expectations that the Bank of England might hold interest rates steady.

- The Bank of Japan plans to reduce government bond purchases, weakening the yen while maintaining its interest rate at 0-0.1%.

I recently attended The Economic Club of New York’s luncheon, at which Treasury Secretary Janet Yellen received the Peter G. Peterson Leadership Excellence Award. Yellen’s remarks focused on a topic that we haven’t heard much about in recent years: supply-side economics, or as she framed it, “expanding our economy’s capacity to produce over the medium and long-term…”

The core of supply-side economics has historically been that government policies oriented toward enhancing aggregate supply can help firms (1) produce more goods and services at lower prices and (2) expand employment as the economy grows. These policies could include decreasing regulation, building infrastructure, or supporting investment in research and development.

I was pleasantly surprised to hear Yellen focus on supply-side economics because demand-side subsidies have been much more popular recently. However, the US economy doesn’t have a demand problem; it has a supply problem, and demand-oriented solutions can exacerbate the problems they are attempting to alleviate.

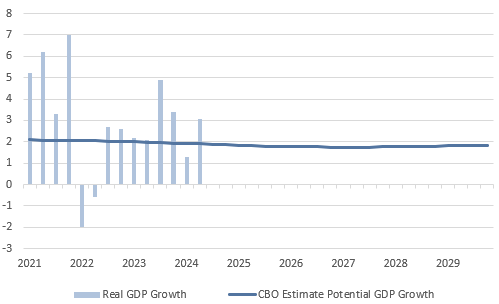

US inflation remains elevated for a simple reason – the real economy hasn’t been able to expand fast enough to support real economic demand (Fig. 1). Too many dollars chasing too few goods and services creates generalized inflation. We can reduce inflation by restraining the economy until growth slows to our current capabilities, or we can orient policy toward creating a business environment that will expand supply to meet demand.

From an investment perspective, lower real economic growth results in lower interest rates and lower corporate earnings, whereas higher real economic growth results in higher interest rates and higher earnings. Expanding our economy’s capacity to produce over the medium and long-term, presuming it is accomplished in a fiscally responsible way, will likely result in higher incomes for Americans and higher returns for investors in balanced portfolios. It’s a win-win from a policy perspective.

Fig. 1: GDP growth has exceeded estimates of potential GDP over the last three years

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.