The Steamroller!

Last Week...

- The Fed faces challenges as the focus shifts from inflation to a weakening labor market, prompted by the jobs report revealing only 114,000 new jobs in July and a rise in the unemployment rate to 4.3%.

- Stock indexes and Treasury yields surged as jobless claims fell to 233,000 from 250,000, with the 10-year yield reaching 4%, and the three main stock indexes rising by 1.4% or more.

- Monday's market selloff, with the S&P 500 dropping 3%, has increased recession risks and speculation that the Federal Reserve might consider a larger half-point rate cut next month.

- Bank of Japan Deputy Gov. Shinichi Uchida reassured markets by promising not to raise interest rates during instability, leading to a surge in Tokyo stock prices and a weakening yen.

The Steamroller!

| I’ve experienced quite a few volatility-related market events in my career. The quant blowup in August 2007, the 2010 flash crash, and February 2018’s “Volmageddon” implosion of short-volatility ETFs come immediately to mind as big ones. We can now add last week’s Yen carry trade unwind to the list.

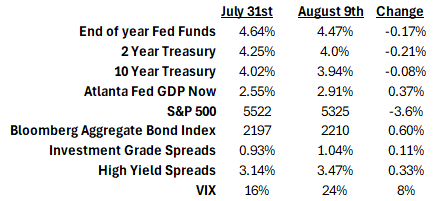

The trades that create volatility events are usually “nickels in front of a steamroller” trades. We generally avoid these types of positions, but hedge funds find them irresistible. You can sell yen (interest expense of 0%) to buy dollars (5% yield), charge 2&20, and print money for a while… but then the yen (aka the steamroller) appreciates in value, and you have a margin call. In order to close the trade, you have to sell dollars and buy back yen, which makes it appreciate even more, and more investors are forced out of the trade – frequently losing years of profit in the meantime. For those interested, we talked more about the yen carry trade in the Livestream we held last Monday while the volatility event was still happening. One other point we made was that some commentators were misinterpreting the carry trade to unwind as a macroeconomic event and calling for emergency Fed rate cuts. It only took about a week for the “crisis” trade that happened Monday morning to get priced back out of the market (Tabel 1). In fact, real-time GDP measures like the Atlanta Fed GDP Now Index have gone up, not down, over the last week. Implied market volatility (VIX) is still a bit elevated, but if you were away on vacation last week you might not have realized anything happened at all. |

Table 1: Markets have normalized after last Monday’s volatility

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.