Trick and Treat

Trick and Treat

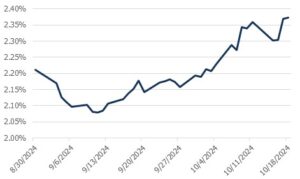

Despite the Fed’s treat of a 50-basis point cut in mid-September, the 10-year Treasury yield has played a trick on many market participants by climbing nearly +60 basis points to 4.2% since then. This move, however, didn’t catch us off guard. In our recent commentary, we highlighted the likelihood of long-term rates increasing even as the Fed cut short-term rates. While the Fed controls the short end of the yield curve, broader economic forces drive longer term interest rates – and those forces are gaining momentum. Last week, Atlanta Fed updated its estimate for third quarter GDP growth to a solid 3.3% and inflation expectations have edged higher (Figure 1). These trends cast doubt on the Fed’s ‘dot plot’ (projects 150 basis points of rate cuts through 2025) and is a driver behind our recent decision to reduce duration across our taxable fixed income portfolios.

Fig. 1: US Federal Reserve Five-Year Forward Five-Year Breakeven Inflation Rate

Source: Bloomberg, Mill Creek.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.