February 2024 Update: “We Continue to Live in Interesting Times”

January Market Recap

- The US Economy remains strong with 353,000 jobs added in January, handedly surpassing market expectations.

- The unemployment rate and labor force participation rate held steady at 3.7% and 62.5%, respectively. The Federal Reserve kept its benchmark interest rate unchanged at 5.25% to 5.50%.

- Fed Chair Powell was more ‘hawkish’ compared to his stance in December and reiterated this view on last night’s ‘60 Minutes’. Fed futures have pushed back the timing of the projected first rate cut to June.

- Long-dated US Treasury yields moved modestly higher while credit spreads stayed within a tight band.

- Growth stocks outperformed value driven by the Magnificent Seven’s continued dominance.

“We Continue to Live in Interesting Times”

I spoke at an investment conference in Florida two weeks ago, and when one of my fellow panelists was asked about her outlook for 2024, she replied, “After three years of COVID whipsaws, I’d say we’re back to normal.” I wish that were the case, but unfortunately, we continue to live in interesting times.

In summary:

- The Fed surprised market participants by signaling an intention to keep policy rates unchanged until May at the earliest,

- The US economy remains resilient, and

- Houthi attacks in the Red Sea have created a significant disruption to global shipping.

The Fed Remains in the Spotlight

As widely expected, the Federal Reserve left the Fed funds rate unchanged in last week’s meeting at 5.25-5.5%. However, an anticipated messaging pivot toward less restrictive policy didn’t occur, and overall, Fed Chair Jerome Powell was more “hawkish” than market participants expected him to be.

January’s press conference displayed the challenges facing the Fed as it tries to communicate transparently about future decisions and create unanimity among voting members on the policy-setting Federal Open Markets Committee (FOMC). At the press conference, he said, “Almost every participant on the FOMC believes it will be appropriate to reduce rates…” but couldn’t provide specific data-driven guidance around the timing of those rate cuts.

Instead, he said, “What we are trying to do is identify a place where we are really confident about inflation getting back down to 2% so we can then begin the process of dialing back the restrictive level.” Unfortunately, the only way to be truly confident that inflation is sustainably at 2% will be to have a recession, in our opinion. Let’s hope that the FOMC doesn’t push it that far, but US recessions, by definition, are Fed policy mistakes.

We’ve written in the past about economists’ dismal record in forecasting recessions, but hindsight into the causes of previous recessions is 20/20. The Fed’s typical mistake is to keep monetary policy too restrictive for too long – and fail to change course before the long and variable lags have done their damage.

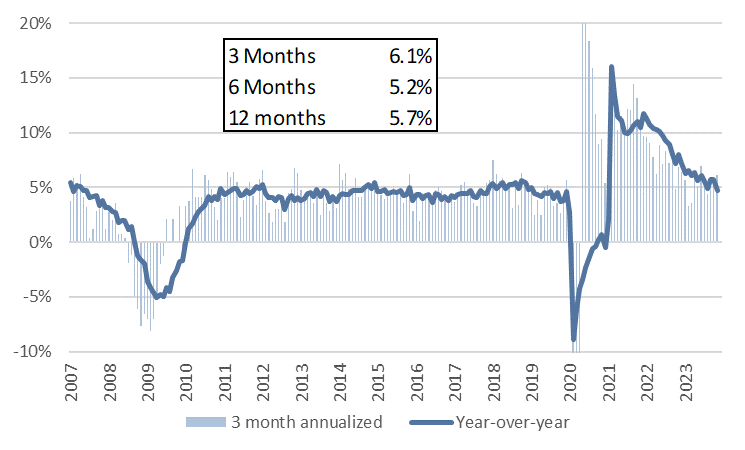

It’s too early to know if the Fed is making the same mistake today. The very early read on first quarter real GDP from the Atlanta Fed for the first quarter came in at a blistering 4.2%, and the Jobs report on Friday was very strong (Fig. 1). No signs of cracks in the US economy so far.

Fig 1: Aggregate Payroll Growth Remains Above the Pre-Covid Average

But Geopolitical Risks Remain Highly Elevated

In a world full of emboldened bad actors, the Houthi, a group removed from the official US-designated terrorist list just two years ago, re-earned a spot on the list in January. By attacking ships going through the southern end of the Red Sea (Fig. 2) in an area called the Bab-el-Mandeb (Gate of Tears), Yemeni-based (and likely Iranian-armed and trained) Houthi militants have managed to cause what appears to be the most significant disruption to global shipping since World War 2.

Fig 2: The Bab el-Mandeb Straight

In response to Houthi attacks, many shipping companies are diverting around Africa – a route that adds 3,500 miles to the trip. It will take some time for the supply chain disruption to impact the US, but Europe and Asia are already feeling the effect. Tesla, for example, recently put production at their German facility on hold.

Geopolitical conflict could certainly derail the soft landing that we’re experiencing in the US by simultaneously pushing up inflation and creating a headwind for growth. We’re monitoring these issues as part of our general market risk assessments and will communicate updates as appropriate.

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.