What Does the Federal Reserve Have to Say About Private Credit?

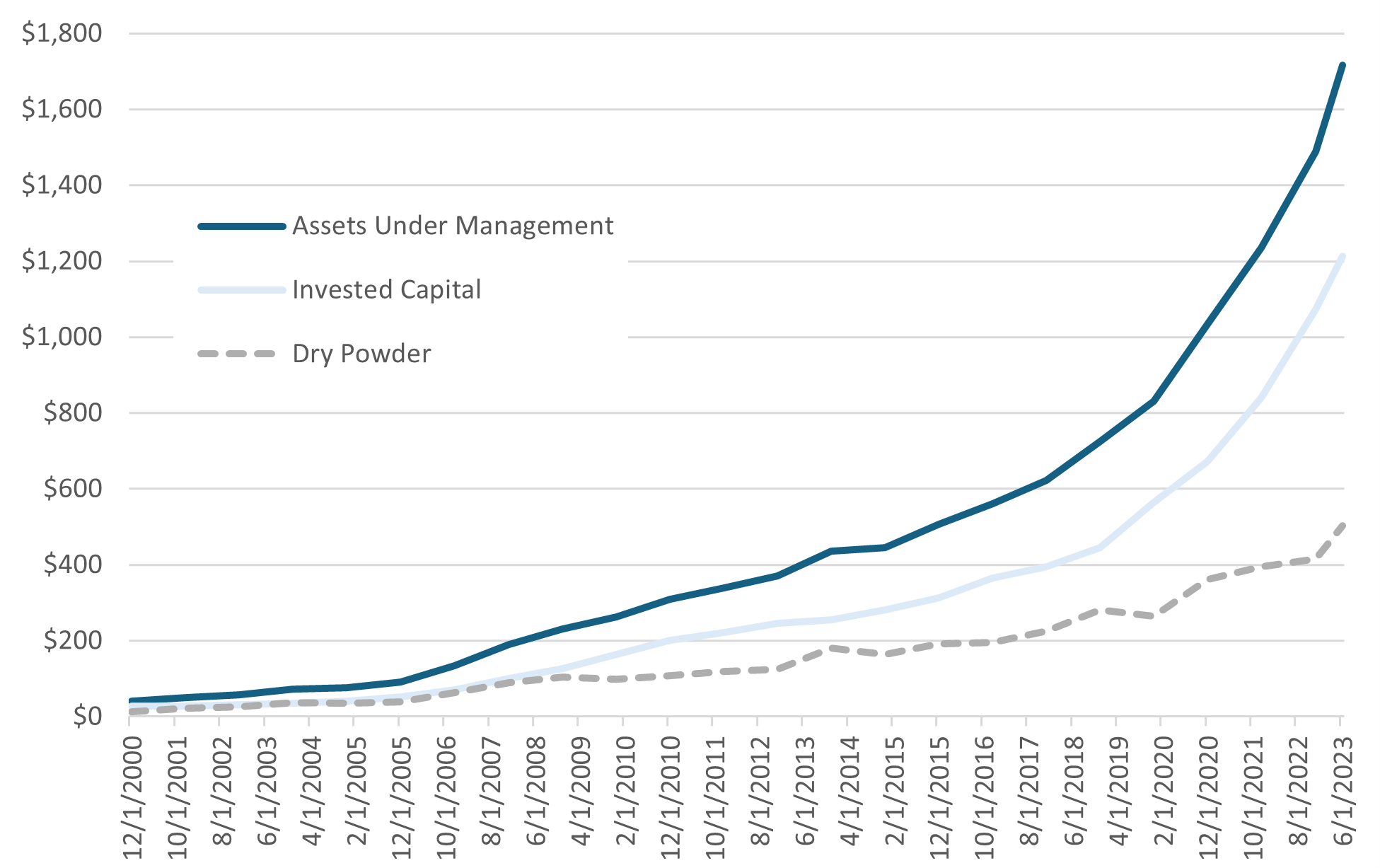

Back in November, US Senators Sherrod Brown (D-OH) and Jack Reed (D-RI) sent a letter to Federal Reserve Vice Chair Michael Barr, FDIC Chair Martin Gruenberg, and Acting Comptroller Michael Hsu, requesting them to assess private credit and potential risks posed to banks and the US financial system. The letter was prompted by the industry’s rapid growth over the past several years and the expanding role of private lenders in the domestic funding markets. Currently, the size of the private debt universe is $1.7 trillion, exceeding both the public US high yield and leveraged loan markets.

While not a direct response to the letter, the Federal Reserve released an inaugural commentary on private credit last week. The main themes discussed weren’t groundbreaking and mostly examined the who/what/why of the space. We believe the most important takeaway lies in the Federal Reserve’s decision to publicly address the topic. It is clear they intend to surveil the ecosystem closely, and we expect additional publications over the coming months and years.

However, one important factor that the Fed highlighted (and something we pay close attention to) is the convergence between the liquid and direct lending (a sub-sector of private debt that most closely mirrors public syndicated bank loans) markets. For instance, year-to-date, 21 companies have refinanced $8.3 billion of debt in the public markets that was previously raised through private channels. Nearly all were in the single-B rating category and paid an average spread of the Secured Overnight Financing Rate (SOFR) plus 420 basis points, representing a four-year low.1 Borrowers toggling back and forth between public and direct lending capital partners creates steep competition for deal flow, leading to lower yields and less restrictive covenant protections. This reason is partially why we’ve decided to look elsewhere for private debt investments.

Like any other asset class, private debt markets will encounter winners and losers. As capital continues to enter the space, we believe following a thoughtful and comprehensive manager due diligence process will be more important than ever for long-term success.

[1] Pitchbook.

Fig. 1: Growth in Private Debt Allocations

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.