Capital Growth Outpaces Liquidity Concerns

Last Week...

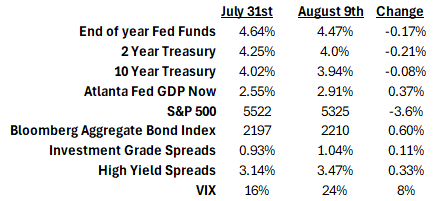

- Federal Reserve officials are gearing up for a likely interest rate cut in September, with many acknowledging a plausible case for a 0.25 percentage point cut at the July meeting due to declining inflation and a weakening labor market.

- Despite a slight slowdown in the U.S. economy, global surveys reveal resilience with modest growth in Europe, driven by the Paris Olympics, and continued strength in Australia, Japan, and India, while concerns persist over the eurozone's long-term outlook.

- US. home sales edged up by 1.3% in July, ending a four-month decline, but prices remain near record highs, keeping many buyers out of the market despite a slight drop in mortgage rates.

- Eurozone wage growth slowed significantly to 3.55% in the second quarter, paving the way for a potential ECB rate cut in September as inflation cools and economic recovery shows signs of faltering.

Capital Growth Outpaces Liquidity Concerns

Recent media coverage of the private equity industry has highlighted concerns about market liquidity and the “stranded” value in funds from 2016-2020 vintage years. While it’s fair to say that distribution paces have slowed and average time to liquidate net asset value (NAV) has increased, we believe this isn’t an existential threat to the market. Instead, it has overshadowed perhaps a more surprising trend impacting the market. Capital formation during 1H 2024 has exceeded expectations (Fig. 1).

As Bloomberg noted on August 8, there is a massive amount of dry powder in the system seeking acquisition targets with seven of the largest publicly traded asset managers holding $722 billion, up 9% from a year earlier. Coupled with anticipated interest rate reductions, we believe it is reasonable to conclude the exit environment should improve materially in the next 6-12 months.

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.