Equity Investor Exuberance in Four Charts

Equity Investor Exuberance in Four Charts

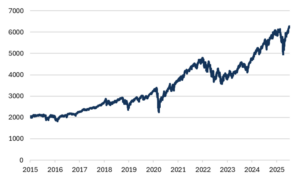

- The S&P 500 has returned to an all-time high (Fig.1).

- The 12-month forward earnings estimates held up during April and have continued to rise since then (Fig. 2), but not as fast as prices.

- Accordingly, the 12-month forward price-to-earnings ratio is back to late-2024 highs (Fig. 3).

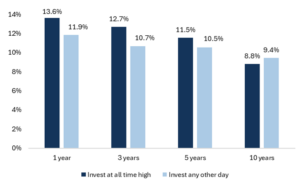

- As a reminder, all-time highs have historically been good entry points for the S&P 500 (Fig. 4).

Why it matters

Equity investors have moved past April’s tariff-induced angina and repriced equities for an optimistic future. While high valuations imply a headwind for returns over 7-10 years, they are not a useful indicator of return expectations over shorter periods. All-time highs have historically offered good entry points in US equity markets.

Fig. 1: S&P 500 Index

Source: Bloomberg, Mill Creek. As of 07/15/2025.

Fig. 2: S&P 500 12-month forward earnings expectations

Source: Bloomberg, Mill Creek. As of 07/15/2025.

Fig. 3: S&P 500 12-month forward price-to-earnings

Source: Bloomberg, Mill Creek. As of 07/15/2025.

Fig. 4: S&P 500 performance based on entry point

Source: Bloomberg, Mill Creek. 09/01/1989-07/15/2025.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.