Charts of the Week: Further Rate Cuts are Unlikely

Charts of the Week: Further Rate Cuts are Unlikely

The Federal Reserve cut the Fed funds rate to a range of 3.5-3.75% last week. Three voting members dissented. Chicago Fed President Austan Goolsbee and Kansas City Fed President Jeffrey Schmid both voted against a cut, whereas newly appointed governor Stephen Miran wanted a 0.5% cut.

Economic data is working against cuts in 2026:

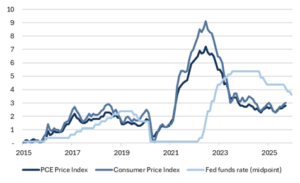

- Inflation remains elevated around 3% (Fig. 1), and

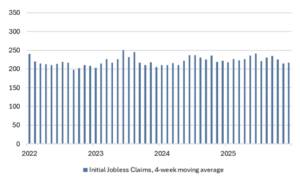

- Labor markets have not deteriorated (Fig. 2).

The Fed pinned the recent rate cut cycle on deteriorating payroll growth, but we knew in real-time [The Labor Market is Slowing, September 15, 2025] that the shutting of the southern border was responsible for much or all of the slowdown. In that vein, the Dallas Fed recently published an article that found a break-even payroll growth rate of 30,000 for the US. While the government shutdown muddled the recent releases, payroll growth appear to still be at or above that rate.

Fig. 1: Inflation and the Fed funds target (%)

Source: Bloomberg, Mill Creek. As of 12/11/2025.

Fig. 2: Initial Jobless Claims have not moved upward

Source: Bloomberg, Mill Creek. As of 12/11/2025.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.