Firms Are Investing in AI, but the Impact Is Uncertain Thus Far

Firms Are Investing in AI, but the Impact Is Uncertain Thus Far

Our Year Ahead publication, A Minsky Moment, discussed the WW2-scale artificial intelligence (AI) investment that is currently underway. As we start 2026, business leaders are optimistic and are planning to invest in AI, but widespread tangible results have yet to show up in company financials.

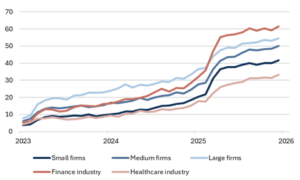

- AI adoption rates have slowed and remain highly varied across industries (Fig. 1).

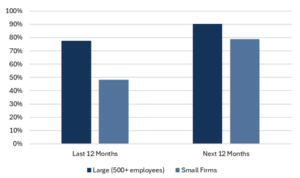

- A substantial majority of firms, large and small, plan to invest in AI in 2026 (Fig. 2).

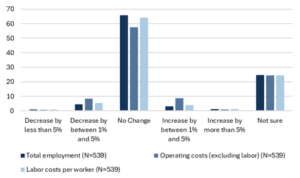

- Chief Financial Officers (CFOs) report that AI has had little impact on their employment and operating costs thus far (Fig. 3), but

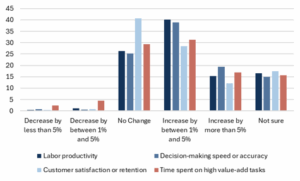

- Are optimistic that over the next 12 months AI will improve labor productivity, help with customer retention, and allow employees to spend more time on high value tasks (Fig. 4).

Fig. 1: AI adoption rates (% of firms), 2023 – 2025

Source: Bloomberg, Mill Creek. As of 12/31/2025.

Fig. 2: Percent of firms investing in AI

Source: Federal Reserve Bank of Richmond, Mill Creek. As of 12/17/2025.

Fig. 3: Muted AI impact over last 12 months (% of responses)

Source: Federal Reserve Bank of Richmond, Mill Creek. As of 12/17/2025.

Fig. 4: CFOs are optimistic about the future of AI (% of responses)

Source: Federal Reserve Bank of Richmond, Mill Creek. As of 12/17/2025.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.