Tariffs and Earnings Season, Part 2

Tariffs and Earnings Season, Part 2

Last quarter, we took a look at the trade environment post – “Liberation Day” and its impact on corporate earnings. At the time (on Apr. 21, to be exact), our observations were as follows:

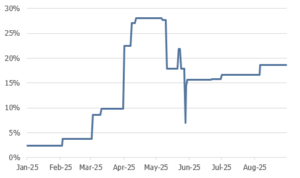

- Tariffs: The estimated effective tariff rate to the US consumer was roughly 28%, orders of magnitude greater than the average rate of less than 5% experienced since the 1970s.

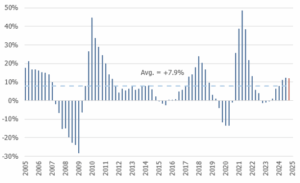

- Earnings Growth: Companies within the S&P 500 had reported year-over-year earnings growth of roughly +7%, in line with historical averages. Once the full quarter had come to a close, this figure was materially higher at +12% YoY.

- Uncertainty: In light of the uncertain trade environment, a number of companies have withdrawn earnings guidance for 2025, adding the potential for increased volatility within equity markets moving forward.

Now that another quarter of trade developments is in the rearview mirror, and the current earnings season is largely complete, we wanted to provide an updated perspective on the above dynamics.

- Tariffs: The past few months have seen a flurry of activity on the trade front, with the US reaching agreements with many of its largest trading partners. In aggregate, the estimated effective tariff rate to the US consumer has declined to approximately 19% (Fig. 1) yet remains significantly higher than the norm of the past few decades.

- Earnings Growth: With roughly 90% of S&P 500 companies having reported Q2 results to date, earnings growth sits at +12% YoY (Fig. 2). This figure is well above the 20-year average of +8% and, if it holds, will mark the index’s third consecutive quarter of double-digit earnings growth.

- Uncertainty: While the trade picture remains volatile, the agreements reached over recent months have provided corporations with a degree of clarity on their operating environment moving forward. Accordingly, earnings guidance withdrawals were largely limited to the early part of last quarter. In fact, many companies that withdrew guidance during the Q1 earnings season (including Delta, American Airlines, UnitedHealth and Ford) have since restored guidance for the year.

Fig. 1: Estimated US Average Effective Tariff Rate, 2025

Source: The Budget Lab at Yale, Mill Creek as of 8/11/2025.

Fig. 2: S&P 500 Annual EPS Growth

Source: Bloomberg, FactSet, Mill Creek as of 8/11/2025.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.