That’s All, Folks!

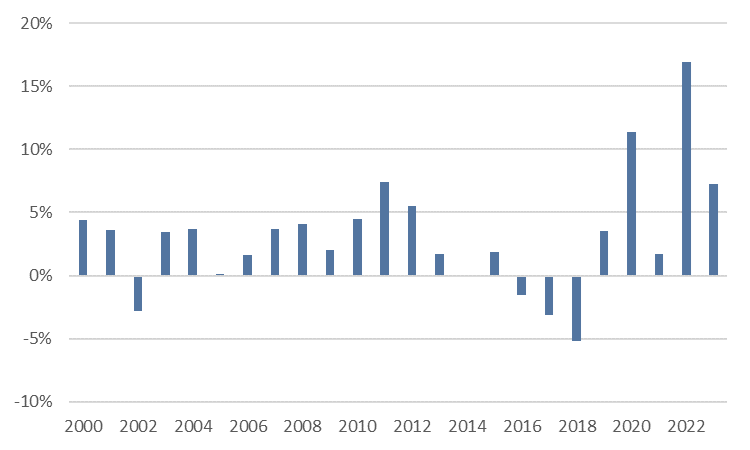

Last week’s Consumer Price Index (CPI) inflation data supported a continued pause by the Federal Reserve (Fig. 1). Inflation increased by 3.2% year-over-year, 3% on a 6-month annualized basis, and 4.1% on a 3-month annualized basis. While none of these data points are commensurate with the Fed’s 2% inflation target, they provide cover for a wait-and-see approach heading into 2024.

Fig. 1: CPI, year-over-year percentage change

If the Fed does not hike in December, it will have been six months since they last raised rates. While the Fed is unwilling to say out loud that July 2023 was their last hike, six months is long enough for us to call an end to the hiking cycle and start looking for cuts in 2024. How much will they be able to cut? The Fed can cut in line with the drop in inflation if economic growth remains stable. In short, if inflation remains sticky at 3-4%, we might not see any cuts. Still, a continued decline in inflation next year would let them lower the Fed Funds rate modestly without policy becoming more accommodative.

Market participants currently expect four cuts in 2024, which (for the first time in years) is a market expectation that seems reasonable to us. A faltering labor market would lead to additional cuts, but sticky inflation could bias the Fed toward no cuts at all. We don’t have enough data at this point to have high conviction against market expectations.

Feathered Inflation

Despite the generally good news around inflation, consumer turkey prices are up 7.3% since last year and 42% since 2019 (Fig. 2). Happy Thanksgiving!

Fig. 2: Uncooked poultry including turkey, year-over-year percentage change (CPI, SA)

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.